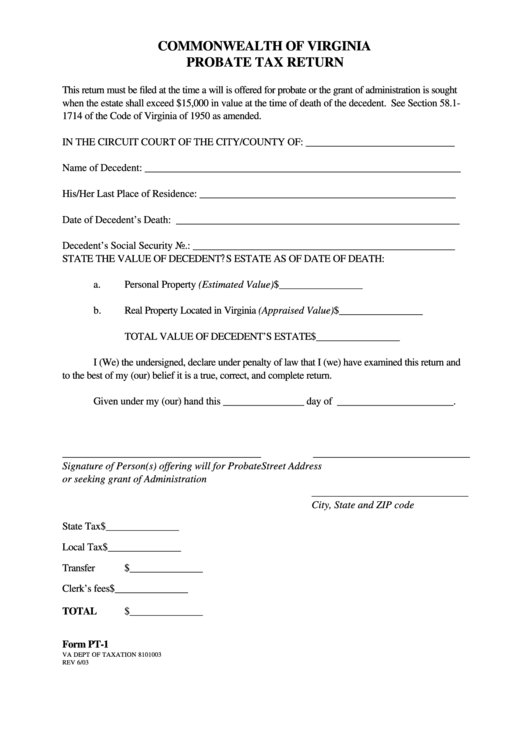

COMMONWEALTH OF VIRGINIA

PROBATE TAX RETURN

This return must be filed at the time a will is offered for probate or the grant of administration is sought

when the estate shall exceed $15,000 in value at the time of death of the decedent. See Section 58.1-

1714 of the Code of Virginia of 1950 as amended.

IN THE CIRCUIT COURT OF THE CITY/COUNTY OF: _____________________________

Name of Decedent: _____________________________________________________________

His/Her Last Place of Residence: __________________________________________________

Date of Decedent’s Death: _______________________________________________________

Decedent’s Social Security No.: ___________________________________________________

STATE THE VALUE OF DECEDENT? S ESTATE AS OF DATE OF DEATH:

a.

Personal Property (Estimated Value) ........................................$________________

b.

Real Property Located in Virginia (Appraised Value) .................$________________

TOTAL VALUE OF DECEDENT’S ESTATE .........................$________________

I (We) the undersigned, declare under penalty of law that I (we) have examined this return and

to the best of my (our) belief it is a true, correct, and complete return.

Given under my (our) hand this ________________ day of _______________________.

______________________________________

______________________________

Signature of Person(s) offering will for Probate

Street Address

or seeking grant of Administration

______________________________

City, State and ZIP code

State Tax

$______________

Local Tax

$______________

Transfer

$______________

Clerk’s fees

$______________

TOTAL

$______________

Form PT-1

VA DEPT OF TAXATION 8101003

REV 6/03

1

1