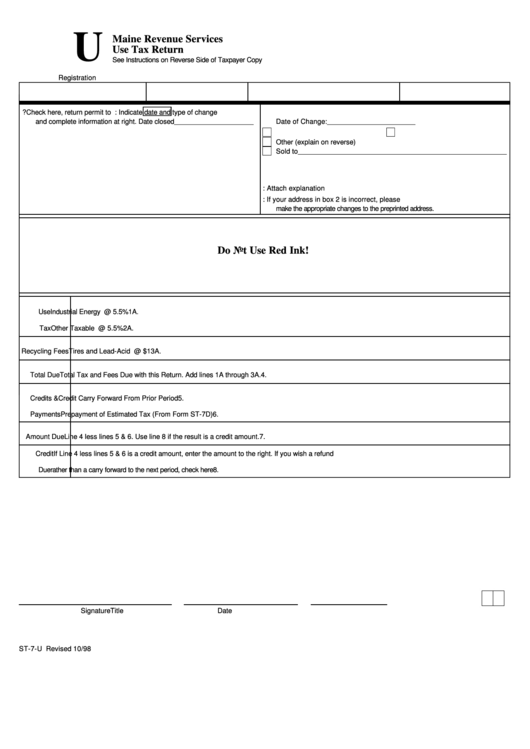

Form St-7-U - Use Tax Return

ADVERTISEMENT

U

Maine Revenue Services

Use Tax Return

See Instructions on Reverse Side of Taxpayer Copy

Registration No.

Business Code

Period Begin

Period End

Due Date

1. Out of Business?

Check here

, return permit to Bureau

3. OW NERSHIP CHANGE: Indicate date and type of change

and complete information at right. Date closed

Date of Change:

___________________________

%

______________________________

%

%

2. Entity Information

Incorporated

Partner added or dropped

%

Other (explain on reverse)

Sold to

_______________________________________________________________________

4. NAME CHANGE: Attach explanation

5. ADDRESS CHANGE: If your address in box 2 is incorrect, please

make the appropriate changes to the preprinted address.

Do Not Use Red Ink!

Use

Industrial Energy Purchases

1.

Tax @ 5.5% 1A.

Tax

Other Taxable Purchases

2.

Tax @ 5.5% 2A.

Recycling Fees Tires and Lead-Acid Batteries

3.

Fees @ $1

3A.

Total Due

Total Tax and Fees Due with this Return. Add lines 1A through 3A.

4.

Credits &

Credit Carry Forward From Prior Period

5.

Payments

Prepayment of Estimated Tax (From Form ST-7D)

6.

Amount Due

Line 4 less lines 5 & 6. Use line 8 if the result is a credit amount.

7.

Credit

If Line 4 less lines 5 & 6 is a credit amount, enter the amount to the right. If you wish a refund

Due

rather than a carry forward to the next period, check here

8.

Signature

Title

Date

ST-7-U Revised 10/98

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1