Georgia Form 500 -Individual Income Tax Return - 1999

ADVERTISEMENT

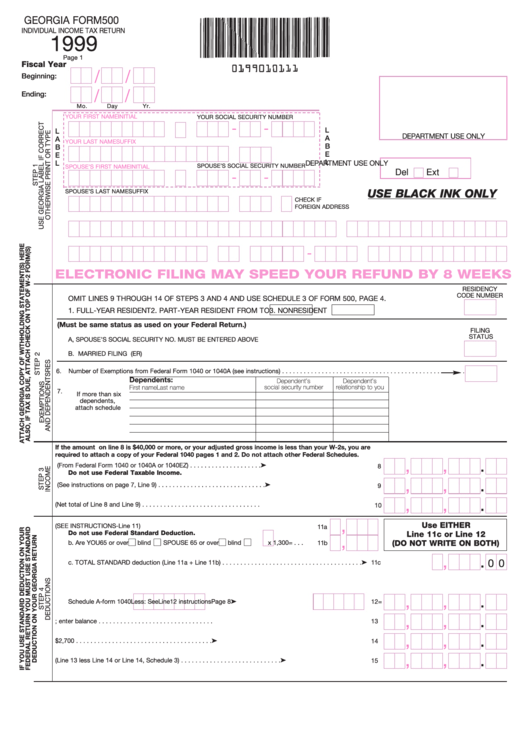

GEORGIA FORM 500

INDIVIDUAL INCOME TAX RETURN

1999

Page 1

Fiscal Year

/

/

Beginning:

/

/

Ending:

Mo.

Day

Yr.

YOUR FIRST NAME

INITIAL

YOUR SOCIAL SECURITY NUMBER

-

-

L

L

DEPARTMENT USE ONLY

A

A

YOUR LAST NAME

SUFFIX

B

B

E

E

L

L

DEPARTMENT USE ONLY

SPOUSE’S SOCIAL SECURITY NUMBER

SPOUSE’S FIRST NAME

INITIAL

Del

Ext

-

-

SPOUSE’S LAST NAME

SUFFIX

USE BLACK INK ONLY

CHECK IF

FOREIGN ADDRESS

2. ADDRESS LINE 1

ADDRESS LINE 2 OR APARTMENT NUMBER

3. CITY

STATE

ZIP CODE

COUNTRY IF FOREIGN

-

ELECTRONIC FILING MAY SPEED YOUR REFUND BY 8 WEEKS

4. Use one number only and enter in the Residency Code box. PART YEAR RESIDENTS AND NONRESIDENTS MUST

RESIDENCY

CODE NUMBER

OMIT LINES 9 THROUGH 14 OF STEPS 3 AND 4 AND USE SCHEDULE 3 OF FORM 500, PAGE 4.

1. FULL-YEAR RESIDENT

2. PART-YEAR RESIDENT FROM

TO

3. NONRESIDENT

5. Fill in Filing Status Block with appropriate letter. (Must be same status as used on your Federal Return.)

FILING

STATUS

A. SINGLE

C. MARRIED FILING SEPARATE, SPOUSE’S SOCIAL SECURITY NO. MUST BE ENTERED ABOVE

B. MARRIED FILING JOINT

D. HEAD OF HOUSEHOLD OR QUALIFYING WIDOW(ER)

6..

Number of Exemptions from Federal Form 1040 or 1040A (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Dependents:

Dependent’s

Dependent’s

First name

Last name

social security number

relationship to you

7.

If more than six

dependents,

attach schedule

If the amount on line 8 is $40,000 or more, or your adjusted gross income is less than your W-2s, you are

required to attach a copy of your Federal 1040 pages 1 and 2. Do not attach other Federal Schedules.

,

,

.

8. Federal adjusted gross income (From Federal Form 1040 or 1040A or 1040EZ) . . . . . . . . . . . . . . . . . . . . ➤

8

Do not use Federal Taxable Income.

,

,

.

9. Adjustments from Schedule 1. (See instructions on page 7, Line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ➤

9

,

,

.

10. Georgia adjusted gross income (Net total of Line 8 and Line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

,

Use EITHER

11. STANDARD Deduction (SEE INSTRUCTIONS-Line 11)

11a

Do not use Federal Standard Deduction.

Line 11c or Line 12

,

b. Are YOU 65 or over

blind

SPOUSE 65 or over

blind

x 1,300= . . .

(DO NOT WRITE ON BOTH)

11b

,

,

.

c. TOTAL STANDARD deduction (Line 11a + Line 11b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ➤

0 0

11c

12. TOTAL ITEMIZED deductions used in computing federal taxable income . . . . . . . . . . . . . . . . . . . . . . . . .

,

,

.

➤

Schedule A-form 1040

Less: See Line 12 instructions Page 8

12=

,

,

.

13. Subtract either Line 11c or Line 12 from Line 10; enter balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

,

,

.

14. Number from block on Line 6_____multiplied by $2,700 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ➤

14

,

,

.

15. Georgia taxable income (Line 13 less Line 14 or Line 14, Schedule 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . ➤

15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4