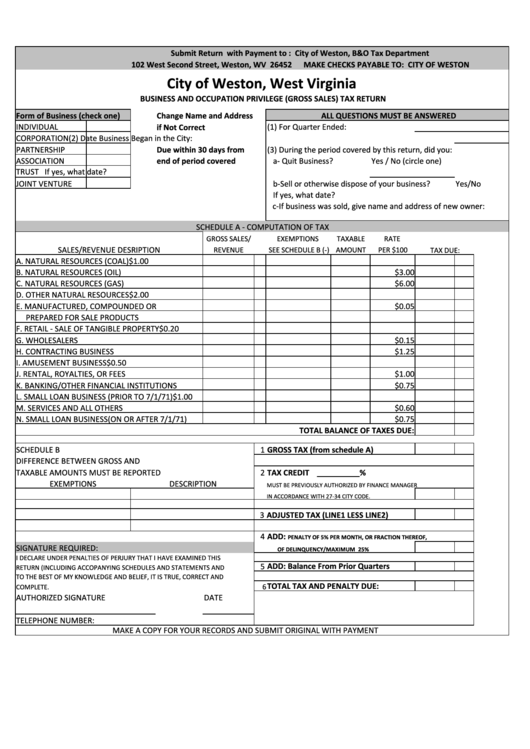

Business And Occupation Privilege (Gross Sales) Tax Return - B&o Tax Department Of City Of Weston, West Virginia

ADVERTISEMENT

Submit Return with Payment to : City of Weston, B&O Tax Department

102 West Second Street, Weston, WV 26452

MAKE CHECKS PAYABLE TO: CITY OF WESTON

City of Weston, West Virginia

BUSINESS AND OCCUPATION PRIVILEGE (GROSS SALES) TAX RETURN

Form of Business (check one)

Change Name and Address

ALL QUESTIONS MUST BE ANSWERED

INDIVIDUAL

if Not Correct

(1) For Quarter Ended:

CORPORATION

(2) Date Business Began in the City:

PARTNERSHIP

Due within 30 days from

(3) During the period covered by this return, did you:

ASSOCIATION

end of period covered

a- Quit Business?

Yes / No (circle one)

TRUST

If yes, what date?

JOINT VENTURE

b-Sell or otherwise dispose of your business?

Yes/No

If yes, what date?

c-If business was sold, give name and address of new owner:

SCHEDULE A - COMPUTATION OF TAX

GROSS SALES/

EXEMPTIONS

TAXABLE

RATE

SALES/REVENUE DESRIPTION

REVENUE

SEE SCHEDULE B (-) AMOUNT

PER $100

TAX DUE:

A. NATURAL RESOURCES (COAL)

$1.00

B. NATURAL RESOURCES (OIL)

$3.00

C. NATURAL RESOURCES (GAS)

$6.00

D. OTHER NATURAL RESOURCES

$2.00

E. MANUFACTURED, COMPOUNDED OR

$0.05

PREPARED FOR SALE PRODUCTS

F. RETAIL - SALE OF TANGIBLE PROPERTY

$0.20

G. WHOLESALERS

$0.15

H. CONTRACTING BUSINESS

$1.25

I. AMUSEMENT BUSINESS

$0.50

J. RENTAL, ROYALTIES, OR FEES

$1.00

K. BANKING/OTHER FINANCIAL INSTITUTIONS

$0.75

L. SMALL LOAN BUSINESS (PRIOR TO 7/1/71)

$1.00

M. SERVICES AND ALL OTHERS

$0.60

N. SMALL LOAN BUSINESS(ON OR AFTER 7/1/71)

$0.75

TOTAL BALANCE OF TAXES DUE:

SCHEDULE B

1 GROSS TAX (from schedule A)

DIFFERENCE BETWEEN GROSS AND

TAXABLE AMOUNTS MUST BE REPORTED

2 TAX CREDIT __________%

EXEMPTIONS

DESCRIPTION

MUST BE PREVIOUSLY AUTHORIZED BY FINANCE MANAGER

IN ACCORDANCE WITH 27-34 CITY CODE.

3 ADJUSTED TAX (LINE1 LESS LINE2)

4 ADD:

PENALTY OF 5% PER MONTH, OR FRACTION THEREOF,

SIGNATURE REQUIRED:

OF DELINQUENCY/MAXIMUM 25%

I DECLARE UNDER PENALTIES OF PERJURY THAT I HAVE EXAMINED THIS

5 ADD: Balance From Prior Quarters

RETURN (INCLUDING ACCOPANYING SCHEDULES AND STATEMENTS AND

TO THE BEST OF MY KNOWLEDGE AND BELIEF, IT IS TRUE, CORRECT AND

TOTAL TAX AND PENALTY DUE:

6

COMPLETE.

AUTHORIZED SIGNATURE

DATE

TELEPHONE NUMBER:

MAKE A COPY FOR YOUR RECORDS AND SUBMIT ORIGINAL WITH PAYMENT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1