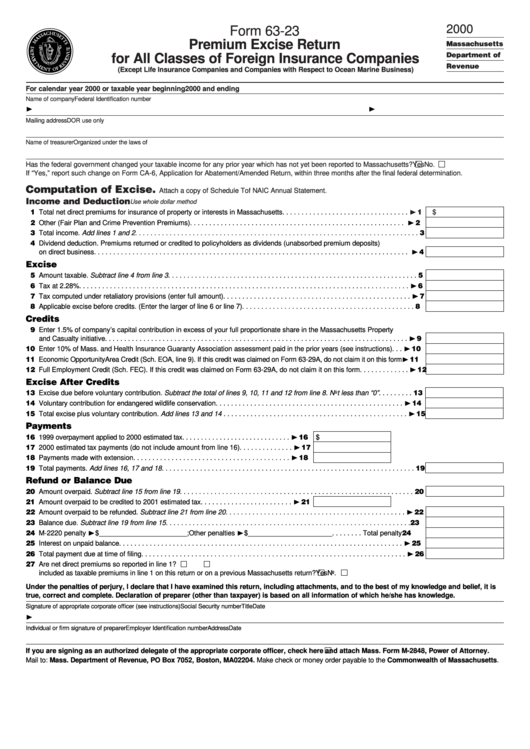

2000

Form 63-23

Premium Excise Return

Massachusetts

Department of

for All Classes of Foreign Insurance Companies

Revenue

(Except Life Insurance Companies and Companies with Respect to Ocean Marine Business)

For calendar year 2000 or taxable year beginning

2000 and ending

Name of company

Federal Identification number

❿

❿

Mailing address

DOR use only

Name of treasurer

Organized under the laws of

Has the federal government changed your taxable income for any prior year which has not yet been reported to Massachusetts?

Yes

No.

If “Yes,” report such change on Form CA-6, Application for Abatement/Amended Return, within three months after the final federal determination.

Computation of Excise.

Attach a copy of Schedule T of NAIC Annual Statement.

Income and Deduction

Use whole dollar method

❿ 1

11 Total net direct premiums for insurance of property or interests in Massachusetts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

12 Other (Fair Plan and Crime Prevention Premiums) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 2

13 Total income. Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

14 Dividend deduction. Premiums returned or credited to policyholders as dividends (unabsorbed premium deposits)

on direct business. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 4

Excise

15 Amount taxable. Subtract line 4 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

16 Tax at 2.28% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 6

17 Tax computed under retaliatory provisions (enter full amount). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 7

18 Applicable excise before credits. (Enter the larger of line 6 or line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Credits

19 Enter 1.5% of company’s capital contribution in excess of your full proportionate share in the Massachusetts Property

and Casualty initiative . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 9

10 Enter 10% of Mass. and Health Insurance Guaranty Association assessment paid in the prior years (see instructions) . . . ❿ 10

11 Economic Opportunity Area Credit (Sch. EOA, line 9). If this credit was claimed on Form 63-29A, do not claim it on this form ❿ 11

12 Full Employment Credit (Sch. FEC). If this credit was claimed on Form 63-29A, do not claim it on this form. . . . . . . . . . . . . ❿ 12

Excise After Credits

13 Excise due before voluntary contribution. Subtract the total of lines 9, 10, 11 and 12 from line 8. Not less than “0” . . . . . . . . . 13

14 Voluntary contribution for endangered wildlife conservation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 14

15 Total excise plus voluntary contribution. Add lines 13 and 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 15

Payments

16 1999 overpayment applied to 2000 estimated tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 16

$

17 2000 estimated tax payments (do not include amount from line 16). . . . . . . . . . . . . . ❿ 17

18 Payments made with extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 18

19 Total payments. Add lines 16, 17 and 18. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

Refund or Balance Due

20 Amount overpaid. Subtract line 15 from line 19. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Amount overpaid to be credited to 2001 estimated tax. . . . . . . . . . . . . . . . . . . . . . . . ❿ 21

22 Amount overpaid to be refunded. Subtract line 21 from line 20. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 22

23 Balance due. Subtract line 19 from line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24 M-2220 penalty ❿$ _______________________ ; Other penalties ❿$ ______________________ . . . . . . . . Total penalty 24

25 Interest on unpaid balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 25

26 Total payment due at time of filing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 26

27 Are net direct premiums so reported in line 1?

Yes

No. Have all dividends claimed as a deduction in line 4 been

included as taxable premiums in line 1 on this return or on a previous Massachusetts return?

Yes

No.

Under the penalties of perjury, I declare that I have examined this return, including attachments, and to the best of my knowledge and belief, it is

true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which he/she has knowledge.

Signature of appropriate corporate officer (see instructions)

Social Security number

Title

Date

❿

Individual or firm signature of preparer

Employer Identification number

Address

Date

If you are signing as an authorized delegate of the appropriate corporate officer, check here

and attach Mass. Form M-2848, Power of Attorney.

Mail to: Mass. Department of Revenue, PO Box 7052, Boston, MA 02204. Make check or money order payable to the Commonwealth of Massachusetts.

1

1 2

2