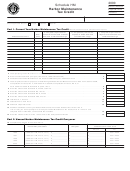

Schedule H - Investment Tax Credit And Carryovers - State Of Massachusetts 2000 Page 2

ADVERTISEMENT

Part 4. Carryovers to Future Years

2000 Schedule H – Page 2

30 Maximum amount of credits eligible for conversion to unlimited carryover status (enter 50% of line 11). . . . . . . . . . . . . . 30

31 1998 carryover (enter amount from line 15e). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

32 1999 carryover (enter amount from line 16e). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

33 2000 carryover (enter amount from line 17e). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

34 1999 carryover from 18e. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

35 2000 carryover from 19e. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

36 1993 10-year carryover (enter amount from line 20e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

37 1994 10-year carryover (enter amount from line 21e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

38 1995 10-year carryover (enter amount from line 22e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

39 1996 10-year carryover (enter amount from line 23e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

40 1997 10-year carryover (enter amount from line 24e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

41 1998 10-year carryover (enter amount from line 25e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

42 1999 10-year carryover (enter amount from line 26e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

43 2000 10-year carryover (enter amount from line 27e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

44 Unlimited carryover:

Carryovers converted to unlimited status. Add lines 13d through 27d . . . . . . . . . . . . 44a

Unlimited carryovers from prior years (enter amount from line 28d) . . . . . . . . . . . . . . 44b

Total. Add lines 44a and 44b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

45 Total credits carried over. Add lines 30 – 44 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 45

Part 5. Reconciliation of Capital Assets in Massachusetts

a.

b.

c.

d.

Property with life

Qualifying

Total

less than 4 years

property

Land

(a + b + c)

46 Beginning of taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

47 Purchases during taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . 47

48 Other acquisitions during taxable year . . . . . . . . . . . . . . . . . . . . 48

❿

49 Sales, exchanges and retirements during taxable year . . . . . . . 49

50 Depreciation taken during taxable year . . . . . . . . . . . . . . . . . . . 50

51 Other adjustments (explain) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

❿

52 End of taxable year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

If line 47, column b differs from line 6, explain the difference. If line 52, column d differs from Schedule A, line 1I, explain the difference.

Schedule H-2. Credit Recapture

Complete Schedule H-2 only if the corporation has investment tax credit, Economic Opportunity Area Credit, or Brownfields Credit to be recaptured.

See instructions.

Property A

Property B

Property C

Description of property (check appropriate box)

ITC

EOA

BC

ITC

EOA

BC

ITC

EOA

BC

31 Original credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

32 Date property was placed in service . . . . . . . . . . . . . . . . . . . . . 12

33 Total months of useful life . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

34 Date property was disposed of or ceased to be in qualified use 14

35 Months of qualified use. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

36 Line 5 divided by line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

%

%

%

37 Recapture percentage. Subtract line 6 from 100% . . . . . . . . . . 17

%

%

%

38 Tentative recapture tax. Line 7 multiplied by line 1 . . . . . . . . . . 18

39 Portion of original credit not used to offset tax in

any year. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

10 Net recapture tax. Subtract line 9 from line 8, but not less

than “0.” Enter here and in line 18 of computation of excise

(Form 355A, 355B, 355C-A or 355C-B) or line 21

(Form 355S-A, 355S-B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2