Print

Clear

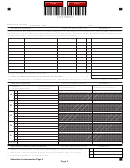

700/2010

Georgia Form

(Partnership) Name_____________________________________________ FEIN ___________________

ADDITIONS TO FEDERAL TAXABLE INCOME

(ROUND TO NEAREST DOLLAR)

SCHEDULE 4 (continued)

4. Federal deduction for income attributable to domestic production activities

4.

(IRC section 199)

5. Intangible expenses and related interest costs .................................................................

5.

6.

6. Captive REIT expenses and costs .......................................................................................

. 7

7. Other additions (Attach schedule) ......................................................................................

8.

. 8

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

9.

9. Total (Add Lines 1 through 8) Enter here and on Line 9, Schedule 7 ................................

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME

(ROUND TO NEAREST DOLLAR)

SCHEDULE 5

1.

. 1

n I

e t

e r

t s

o

n

o

b

g i l

a

o i t

s n

f o

U

n

e t i

d

t S

t a

s e

(must be reduced by direct and indirect interest expense)

2. Exception to intangible expenses and related interest cost (Attach IT-Addback).........

2.

3. Exception to captive REIT expenses and costs (Attach IT-REIT)................................

3.

4. Other subtractions (Attach Schedule)................................................................................

4.

. 5

. . . .

. . . .

. . . .

. . . .

. . . .

. . . .

. . . .

. . . .

. . . .

. . . .

. . . .

. . . .

5.

. 6

. . . .

. . . .

. . . .

. . . .

. . . .

. . . .

. . . .

. . . .

. . . .

. . . .

. . . .

. . . .

6.

7.

7.

Total (Add Lines 1 through 6) enter here and on Line 11, Schedule 7........................................

APPORTIONMENT OF INCOME

(ROUND TO NEAREST DOLLAR)

SCHEDULE 6

A. WITHIN GEORGIA

B. EVERYWHERE

C. DO NOT ROUND COL (A)/ COL (B)

COMPUTE TO SIX DECIMALS

1.

1. Gross receipts from business...........................................

2.

2. Georgia Ratio (Divide Column A by Column B)...................

COMPUTATION OF TOTAL INCOME FOR GEORGIA PURPOSES (ROUND TO NEAREST DOLLAR)

SCHEDULE 7

1. Ordinary income (loss) ...............................................................................................

1.

2. Net income (loss) from rental real estate activities

.......................................

2.

3. a. Gross income from other rental activities ........

3a.

b. Less expenses (attach schedule) ...................

3b.

c. Net income (loss) from other rental activities (Line 3a less Line 3b) ...................

3c.

4. Portfolio income (loss):

a. Interest Income ..............................................................

4a.

b. Dividend Income ............................................................

4b.

c. Royalty Income ..............................................................

4c.

d. Net short-term capital gain (loss) .................................

4d.

e. Net long-term capital gain (loss) ..................................

4e.

f. Other portfolio income (loss) ........................................

4f.

5. Guaranteed payments to partners ..............................................................................

5.

6. Net gain (loss) under Section 1231 ............................................................................

6.

7. Other Income (loss) ....................................................................................................

7.

8. Total Federal income (add Lines 1 through 7) ...........................................................

8.

9. Additions to Federal income (Schedule 4, above ) .....................................................

9.

10. Total (add Lines 8 and 9) ............................................................................................

10.

11. Subtractions from Federal income (Schedule 5, above ) .......... . .................................

11.

12. Total income for Georgia purposes (Line 10 less Line 11) .......................................

12.

Other Requ ired Federal Inform ation

1.

Salaries and wages (Form 1065, Page 1, Line 9) .....................................................

1.

2.

Taxes and licenses (Form 1065, Page 1, Line 14) ....................................................

2.

3.

Section 179 deduction (Form 1065, Page 4, Line 12) ...............................................

3.

4.

Contributions (Form 1065, Page 4, Line 13a) ............................................................

4.

5.

Investment interest expense (Form 1065, Page 4, Line 13b) ....................................

5.

6.

Section 59(e)(2) expenditures (Form 1065, Page 4, Line 13c) ..................................

6.

Page 3

1

1 2

2 3

3