Form As-22 - City Of Dayton Refund Request Page 2

ADVERTISEMENT

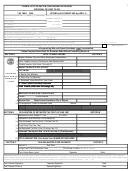

Refund Calculation Worksheet

I

Compute the amount to be entered as taxable city income by multiplying the total compensation by

the ratio of actual days worked. Days worked only refers to actual days on the job.

I

Refunds cannot be claimed for 12 (twelve days) or less days if taxes were not paid to another

municipality for those days.

I

Refund cannot be claimed for virtual office unless it is a requirement of your employment.

Please furnish a letter from your employer on a company letterhead.

EXAMPLE

YOUR CALCULATIONS

1.

261

1.) TOTAL DAYS AVAILABLE

(365 MINUS WEEKENDS NOT WORKED)

a

10

a. VACATION

b

12

b. SICK LEAVE

10

c

c. HOLIDAYS

2.

32

2.) LESS: TOTAL AVAILABLE DAYS NOT WORKED

(ADD a, b & c).

3.

229

3.) SUBTRACT LINE 2 FROM LINE 1

70

4.

4.) LESS: DAYS WORKED OUT OF TOWN

*Remember to attach list of dates and locations.

5.

159

5.) DAYS ON JOB IN THE CITY OF DAYTON

WAGES ON WHICH INCOME TAX IS TO BE PAID

(DIVIDE) (5) DAYS ON THE JOB IN THE CITY

TOTAL INCOME

TAXABLE INCOME

X

=

(3) TOTAL AVAILABLE WORK DAYS

(COLUMN A)

(COLUMN C)

COMPUTATION: (LINE 5) _________________

X

$

=

$

(LINE 3)

Tax Rate for the City of Dayton ........…………….....................2.25%

To have this form

completed in person at

Total Tax Due (To Column D)

(Taxable Income X Tax Rate)

$

our office, you must have

an appointment.

Less: Tax Withheld (To Column E)

Please contact our office

$

for an appointment at

(937) 333-3500.

Refund Due (To Column G)

$

File with: City of Dayton

Income Tax

P.O. Box 1823

Dayton, Ohio 45401-1823

Phone: (937) 333-3500 • Fax: (937) 333-4280 • Forms: (937) 333-3501

website:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2