Form As-22 - City Of Dayton Refund Request

ADVERTISEMENT

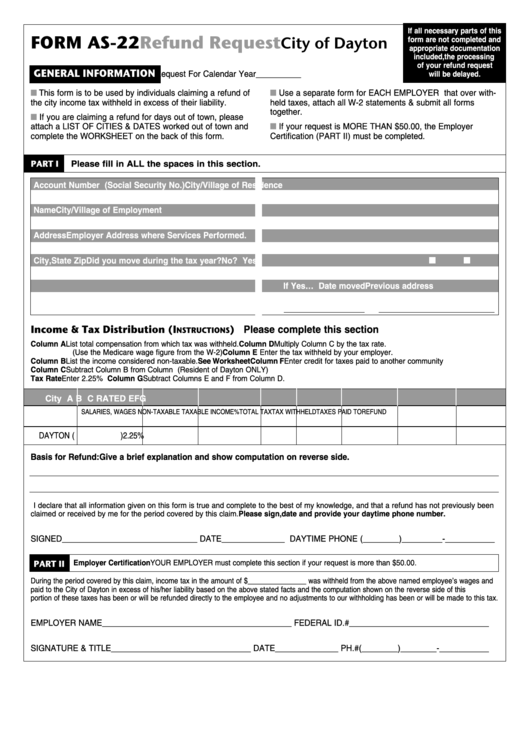

If all necessary parts of this

FORM AS-22

Refund Request

City of Dayton

form are not completed and

appropriate documentation

included, the processing

of your refund request

GENERAL INFORMATION

Request For Calendar Year__________

will be delayed.

I

I

This form is to be used by individuals claiming a refund of

Use a separate form for EACH EMPLOYER that over with-

the city income tax withheld in excess of their liability.

held taxes, attach all W-2 statements & submit all forms

I

together.

If you are claiming a refund for days out of town, please

I

attach a LIST OF CITIES & DATES worked out of town and

If your request is MORE THAN $50.00, the Employer

complete the WORKSHEET on the back of this form.

Certification (PART II) must be completed.

PART I

Please fill in ALL the spaces in this section.

Account Number (Social Security No.)

City/Village of Residence

Name

City/Village of Employment

Address

Employer Address where Services Performed.

City, State Zip

Did you move during the tax year?

No?

Yes?

If Yes… Date moved

Previous address

Income & Tax Distribution (I

) Please complete this section

NSTRUCTIONS

Column A List total compensation from which tax was withheld.

Column D Multiply Column C by the tax rate.

(Use the Medicare wage figure from the W-2)

Column E

Enter the tax withheld by your employer.

Column B List the income considered non-taxable. See Worksheet

Column F

Enter credit for taxes paid to another community

Column C Subtract Column B from Column A.

on the same income. (Resident of Dayton ONLY)

Tax Rate

Column G Subtract Columns E and F from Column D.

Enter 2.25%

City

A

B

C

RATE

D

E

F

G

SALARIES, WAGES

NON-TAXABLE

TAXABLE INCOME

%

TOTAL TAX

TAX WITHHELD

TAXES PAID TO

REFUND

ETC.

INCOME

ANOTHER CITY

DAYTON

(

)

2.25%

Basis for Refund: Give a brief explanation and show computation on reverse side.

I declare that all information given on this form is true and complete to the best of my knowledge, and that a refund has not previously been

claimed or received by me for the period covered by this claim. Please sign, date and provide your daytime phone number.

SIGNED______________________________ DATE______________ DAYTIME PHONE (________)_________-___________

PART II

Employer Certification YOUR EMPLOYER must complete this section if your request is more than $50.00.

During the period covered by this claim, income tax in the amount of $_______________ was withheld from the above named employee’s wages and

paid to the City of Dayton in excess of his/her liability based on the above stated facts and the computation shown on the reverse side of this form. No

portion of these taxes has been or will be refunded directly to the employee and no adjustments to our withholding has been or will be made to this tax.

EMPLOYER NAME__________________________________________ FEDERAL ID. #_______________________________

SIGNATURE & TITLE_______________________________ DATE______________ PH. #(________)________-___________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2