Form Kw-3 - Annual Reconciliation

ADVERTISEMENT

F

KW-3 (

. 10/01)

ORM

REV

A

R

NNUAL

ECONCILIATION

(Y

) _______

EAR

P.O. B

293100 / K

, O

45429-9100

OX

ETTERING

HIO

N

W-2’

A

T

T

R

UMBER OF

S

TTACHED

OTAL

AX

EMITTED

SUBMIT THIS

J

.

A

J

O

.

AN

PRIL

ULY

CT

FORM

WITH W-2’s BY

T

K

T

N

E

F

.

M

A

.

N

.

OTAL

ETTERING

AX

UMBER OF

MPLOYEES AT

EB

AY

UG

OV

W

P

W-2’

C

Y

E

ITHHELD

ER

S

ALENDAR

EAR

ND

FEBRUARY 28.

M

J

S

.

D

.

ARCH

UNE

EPT

EC

D

D

IFFERENCE

UE OR

If overpaid, check one:

*

1

Q

.

2

Q

.

3

Q

.

4

Q

.

<O

>

ST

TR

ND

TR

RD

TR

TH

TR

VERPAID

o Credit o Refund

*see instructions on reverse side

If name or address is incorrect, make necessary changes.

Federal ID No. ___________________________

I hereby certify that the information and statements contained herein are true and correct.

Signed by ___________________________________________

Date ____________

R

O

ESPONSIBLE

FFICER

Print Name __________________________________________

R

O

ESPONSIBLE

FFICER

F

KW-3 (

. 10/01)

ORM

REV

A

R

NNUAL

ECONCILIATION

(Y

) _______

EAR

P.O. B

293100 / K

, O

45429-9100

OX

ETTERING

HIO

N

W-2’

A

T

T

R

UMBER OF

S

TTACHED

OTAL

AX

EMITTED

KEEP

J

.

A

J

O

.

AN

PRIL

ULY

CT

THIS

T

K

T

N

E

F

.

M

A

.

N

.

OTAL

ETTERING

AX

UMBER OF

MPLOYEES AT

EB

AY

UG

OV

W

P

W-2’

C

Y

E

ITHHELD

ER

S

ALENDAR

EAR

ND

COPY

M

J

S

.

D

.

ARCH

UNE

EPT

EC

D

D

IFFERENCE

UE OR

If overpaid, check one:

*

<O

>

1

Q

.

2

Q

.

3

Q

.

4

Q

.

VERPAID

ST

TR

ND

TR

RD

TR

TH

TR

o Credit o Refund

*see instructions on reverse side

If name or address is incorrect, make necessary changes.

Federal ID No. ___________________________

I hereby certify that the information and statements contained herein are true and correct.

Signed by ___________________________________________

Date ____________

R

O

ESPONSIBLE

FFICER

Print Name __________________________________________

R

O

ESPONSIBLE

FFICER

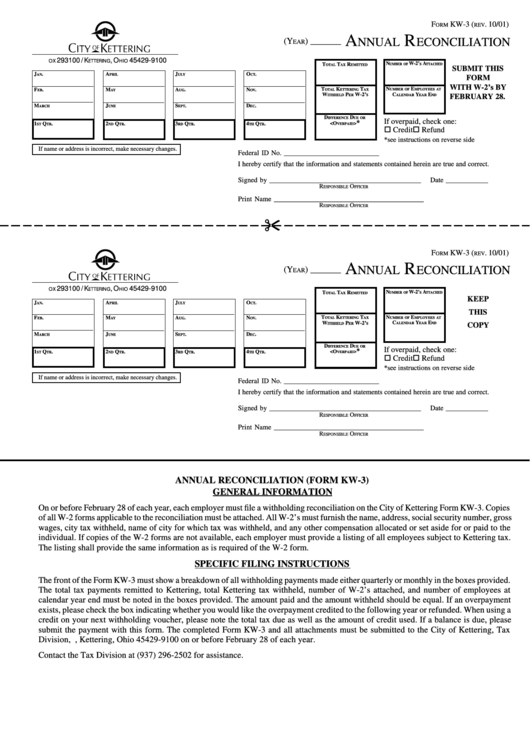

ANNUAL RECONCILIATION (FORM KW-3)

GENERAL INFORMATION

On or before February 28 of each year, each employer must file a withholding reconciliation on the City of Kettering Form KW-3. Copies

of all W-2 forms applicable to the reconciliation must be attached. All W-2’s must furnish the name, address, social security number, gross

wages, city tax withheld, name of city for which tax was withheld, and any other compensation allocated or set aside for or paid to the

individual. If copies of the W-2 forms are not available, each employer must provide a listing of all employees subject to Kettering tax.

The listing shall provide the same information as is required of the W-2 form.

SPECIFIC FILING INSTRUCTIONS

The front of the Form KW-3 must show a breakdown of all withholding payments made either quarterly or monthly in the boxes provided.

The total tax payments remitted to Kettering, total Kettering tax withheld, number of W-2’s attached, and number of employees at

calendar year end must be noted in the boxes provided. The amount paid and the amount withheld should be equal. If an overpayment

exists, please check the box indicating whether you would like the overpayment credited to the following year or refunded. When using a

credit on your next withholding voucher, please note the total tax due as well as the amount of credit used. If a balance is due, please

submit the payment with this form. The completed Form KW-3 and all attachments must be submitted to the City of Kettering, Tax

Division, P.O. Box 293100, Kettering, Ohio 45429-9100 on or before February 28 of each year.

Contact the Tax Division at (937) 296-2502 for assistance.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1