Name

SSN

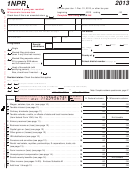

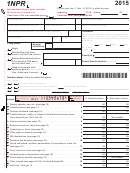

2 of 4

2012

Form 1NPR

Page

A. Federal column

B. Wisconsin column

Adjustments to Income

17 RESERVED . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Not deductible for Wisconsin

18 Certain business expenses of reservists, performing artists, and

fee-basis government officials (see page 21) . . . . . . . . . . . . . . . . . . . . . 18

.00

.00

.00

.00

19 Health savings account deduction (see page 21) . . . . . . . . . . . . . . . . . . 19

.00

.00

20 Moving expenses (see page 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

.00

.00

21 Deductible part of self-employment tax (see page 21) . . . . . . . . . . . . . . . 21

22 Self-employed SEP, SIMPLE, and qualified plans (see page 21) . . . . . . 22

.00

.00

.00

.00

23 Self-employed health insurance deduction (see page 21) . . . . . . . . . . . 23

.00

.00

24 Penalty on early withdrawal of savings (see page 21) . . . . . . . . . . . . . . . 24

.00

.00

25 Alimony paid (see page 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

.00

.00

26 IRA deduction (see page 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

.00

.00

27 Student loan interest deduction (see page 22) . . . . . . . . . . . . . . . . . . . . 27

Not deductible for Wisconsin

28 RESERVED . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

Not deductible for Wisconsin

29 Domestic production activities deduction (see page 22) . . . . . . . . . . . . 29

30 Other adjustments included in Form 1040, line 36 (see page 22)

.00

.00

(list type and amount)

30

.00

.00

31 Total adjustments to income. Add lines 17 through 30 . . . . . . . . . . . . . 31

Adjusted Gross Income

.00

32 Wisconsin income. Subtract line 31, column B from line 16, column B . . 32

.00

33 Federal income. Subtract line 31, column A from line 16, column A . . . . 33

34 Divide line 32 by line 33. Carry the decimal to four places. If amount

on line 32 is more than amount on line 33, fill in 1.0000.

.

. . . 34

(See page 22)

Tax Computation

35 Fill in the larger of Wisconsin income from line 32, column B or federal income from line 33,

.00

column A. But, if Wisconsin income from line 32 is zero or less, fill in 0 (zero) . . . . . . . . . . . . . . 35

36a If you (or your spouse) can be claimed as a dependent on anyone else’s return, check here

and see the “Exception” in the instructions for line 36c on page 22 . . . . . . . . . . . . . . . . . . . . . . . 36a

36b Aliens (see page 22 to determine if you must check line 36b) . . . . . . . . . . . . . . . . . . . . . . . . . . . 36b

.00

36c Find the standard deduction for amount on line 33 using table on page 37 . . . . . . . . . . . . . . . . . 36c

37 Subtract line 36c from line 35. If line 36c is more than line 35, fill in 0 (zero) . . . . . . . . . . . . . . . . 37

.00

38 Exemptions (Caution: see page 23)

.00

a Fill in exemptions from your federal return

x $700 . . 38a

.00

b Check if 65 or older

You +

Spouse =

x $250 . . 38b

.00

c Add lines 38a and 38b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38c

39 Subtract line 38c from line 37. If line 38c is more than line 37, fill in 0 (zero) . . . . . . . . . . . . . . . . 39

.00

40 Tax (see table on page 40) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

.00

41 Itemized deduction credit.

.00

. . . . 41

Complete Schedule 1 (page 4, Form 1NPR)

42 School property tax credits (part-year and full-year residents only)

}

.00

Find credit from

a

Rent paid in 2012–heat included

.00

42a

table page 24 . . . .

.00

Rent paid in 2012–heat not included

Find credit from

.00

.00

b

Property taxes paid on home in 2012

42b

table page 25 . . . .

.00

43 Add credits on lines 41, 42a, and 42b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

44 Subtract line 43 from line 40. If line 43 is more than line 40, fill in 0 (zero) . . . . . . . . . . . . . . . . . 44

.00

x .

45 Fill in ratio from line 34 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

.00

46 Multiply line 44 by ratio on line 45 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

Go to Page 3

Return to Page 1

1

1 2

2 3

3 4

4