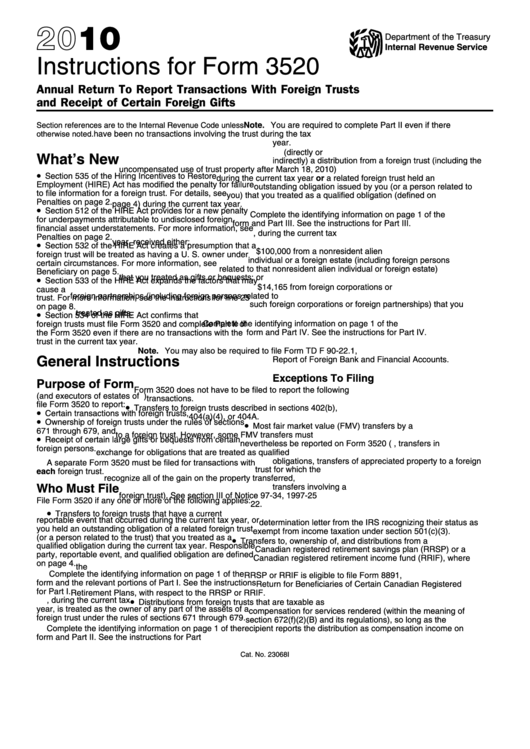

Instructions For Form 3520 - Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts - 2010

ADVERTISEMENT

2010

Department of the Treasury

Internal Revenue Service

Instructions for Form 3520

Annual Return To Report Transactions With Foreign Trusts

and Receipt of Certain Foreign Gifts

Note. You are required to complete Part II even if there

Section references are to the Internal Revenue Code unless

have been no transactions involving the trust during the tax

otherwise noted.

year.

3. You are a U.S. person who received (directly or

What’s New

indirectly) a distribution from a foreign trust (including the

uncompensated use of trust property after March 18, 2010)

•

Section 535 of the Hiring Incentives to Restore

during the current tax year or a related foreign trust held an

Employment (HIRE) Act has modified the penalty for failure

outstanding obligation issued by you (or a person related to

to file information for a foreign trust. For details, see

you) that you treated as a qualified obligation (defined on

Penalties on page 2.

page 4) during the current tax year.

•

Section 512 of the HIRE Act provides for a new penalty

Complete the identifying information on page 1 of the

for underpayments attributable to undisclosed foreign

form and Part III. See the instructions for Part III.

financial asset understatements. For more information, see

4. You are a U.S. person who, during the current tax

Penalties on page 2.

year, received either:

•

Section 532 of the HIRE Act creates a presumption that a

a. More than $100,000 from a nonresident alien

foreign trust will be treated as having a U. S. owner under

individual or a foreign estate (including foreign persons

certain circumstances. For more information, see U.S.

related to that nonresident alien individual or foreign estate)

Beneficiary on page 5.

that you treated as gifts or bequests; or

•

Section 533 of the HIRE Act expands the factors that may

b. More than $14,165 from foreign corporations or

cause a U.S. person to be treated as the owner of a foreign

foreign partnerships (including foreign persons related to

trust. For more information, see the instructions for line 25

such foreign corporations or foreign partnerships) that you

on page 8.

•

treated as gifts.

Section 534 of the HIRE Act confirms that U.S. owners of

Complete the identifying information on page 1 of the

foreign trusts must file Form 3520 and complete Part II of

the Form 3520 even if there are no transactions with the

form and Part IV. See the instructions for Part IV.

trust in the current tax year.

Note. You may also be required to file Form TD F 90-22.1,

General Instructions

Report of Foreign Bank and Financial Accounts.

Exceptions To Filing

Purpose of Form

Form 3520 does not have to be filed to report the following

U.S. persons (and executors of estates of U.S. decedents)

transactions.

file Form 3520 to report:

•

Transfers to foreign trusts described in sections 402(b),

•

Certain transactions with foreign trusts,

404(a)(4), or 404A.

•

Ownership of foreign trusts under the rules of sections

•

Most fair market value (FMV) transfers by a U.S. person

671 through 679, and

to a foreign trust. However, some FMV transfers must

•

Receipt of certain large gifts or bequests from certain

nevertheless be reported on Form 3520 (e.g., transfers in

foreign persons.

exchange for obligations that are treated as qualified

obligations, transfers of appreciated property to a foreign

A separate Form 3520 must be filed for transactions with

trust for which the U.S. transferor does not immediately

each foreign trust.

recognize all of the gain on the property transferred,

Who Must File

transfers involving a U.S. transferor that is related to the

foreign trust). See section III of Notice 97-34, 1997-25 I.R.B.

File Form 3520 if any one or more of the following applies:

22.

1. You are the responsible party for reporting a

•

Transfers to foreign trusts that have a current

reportable event that occurred during the current tax year, or

determination letter from the IRS recognizing their status as

you held an outstanding obligation of a related foreign trust

exempt from income taxation under section 501(c)(3).

(or a person related to the trust) that you treated as a

•

Transfers to, ownership of, and distributions from a

qualified obligation during the current tax year. Responsible

Canadian registered retirement savings plan (RRSP) or a

party, reportable event, and qualified obligation are defined

Canadian registered retirement income fund (RRIF), where

on page 4.

the U.S. citizen or resident alien holding an interest in such

Complete the identifying information on page 1 of the

RRSP or RRIF is eligible to file Form 8891, U.S. Information

form and the relevant portions of Part I. See the instructions

Return for Beneficiaries of Certain Canadian Registered

for Part I.

Retirement Plans, with respect to the RRSP or RRIF.

2. You are a U.S. person who, during the current tax

•

Distributions from foreign trusts that are taxable as

year, is treated as the owner of any part of the assets of a

compensation for services rendered (within the meaning of

foreign trust under the rules of sections 671 through 679.

section 672(f)(2)(B) and its regulations), so long as the

Complete the identifying information on page 1 of the

recipient reports the distribution as compensation income on

form and Part II. See the instructions for Part II.

its applicable federal income tax return.

Cat. No. 23068I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15