Form Gr-1065 - Partnership Income Tax Return-Grand Rapids - 2011

ADVERTISEMENT

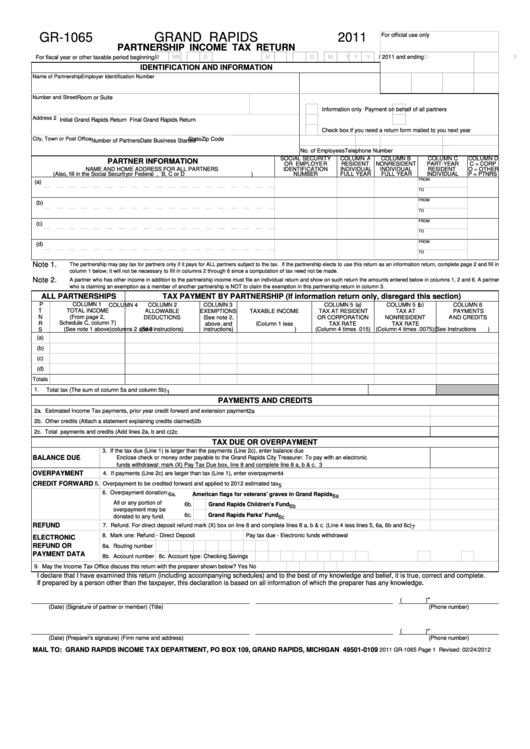

GR-1065

GRAND RAPIDS

2011

For official use only

PARTNERSHIP INCOME TAX RETURN

M

M

D

D

/ 2011 and ending

M

M

D

D

Y

Y

Y

Y

For fiscal year or other taxable period beginning

/

/

/

IDENTIFICATION AND INFORMATION

Name of Partnership

Employer Identification Number

Number and Street

Room or Suite No. Mark all boxes that apply

Information only

Payment on behalf of all partners

Address 2

Initial Grand Rapids Return

Final Grand Rapids Return

Check box if you need a return form mailed to you next year

City, Town or Post Office

State

Zip Code

Number of Partners

Date Business Started

No. of Employees

Telephone Number

SOCIAL SECURITY

COLUMN A

COLUMN B

COLUMN C

COLUMN D

PARTNER INFORMATION

OR EMPLOYER

RESIDENT

NONRESIDENT

PART-YEAR

C = CORP

NAME AND HOME ADDRESS FOR ALL PARTNERS

IDENTIFICATION

INDIVIDUAL

INDIVIDUAL

RESIDENT

O = OTHER

(Also, fill in the Social Security or Federal I.D. number and Column A, B, C or D)

NUMBER

FULL YEAR

FULL YEAR

INDIVIDUAL

P = PTNRS

FROM

(a)

TO

FROM

(b)

TO

FROM

(c)

TO

FROM

(d)

TO

Note 1.

The partnership may pay tax for partners only if it pays for ALL partners subject to the tax. If the partnership elects to use this return as an information return, complete page 2 and fill in

column 1 below; it will not be necessary to fill in columns 2 through 6 since a computation of tax need not be made.

Note 2.

A partner who has other income in addition to the partnership income must file an individual return and show on such return the amounts entered below in columns 1, 2 and 6. A partner

who is claiming an exemption as a member of another partnership is NOT to claim the exemption in this partnership return in column 3.

ALL PARTNERSHIPS

TAX PAYMENT BY PARTNERSHIP (If information return only, disregard this section)

P

COLUMN 1

COLUMN 2

COLUMN 3

COLUMN 4

COLUMN 5 (a)

COLUMN 5 (b)

COLUMN 6

TOTAL INCOME

T

ALLOWABLE

EXEMPTIONS

TAXABLE INCOME

TAX AT RESIDENT

TAX AT

PAYMENTS

(From page 2,

N

DEDUCTIONS

(See note 2,

OR CORPORATION

NONRESIDENT

AND CREDITS

Schedule C, column 7)

R

above, and

(Column 1 less

TAX RATE

TAX RATE

(See instructions)

instructions)

columns 2 and 3)

(Column 4 times .015)

(Column 4 times .0075)

(See Instructions)

S

(See note 1 above)

(a)

(b)

(c)

(d)

Totals

1.

Total tax (The sum of column 5a and column 5b)

1

PAYMENTS AND CREDITS

2a. Estimated Income Tax payments, prior year credit forward and extension payment

2a

2b. Other credits (Attach a statement explaining credits claimed)

2b

2c. Total payments and credits (Add lines 2a, b and c)

2c

TAX DUE OR OVERPAYMENT

3. If the tax due (Line 1) is larger than the payments (Line 2c), enter balance due

BALANCE DUE

Enclose check or money order payable to the Grand Rapids City Treasurer. To pay with an electronic

funds withdrawal: mark (X) Pay Tax Due box, line 8 and complete line 8 a, b & c.

3

OVERPAYMENT

4. If payments (Line 2c) are larger than tax (Line 1), enter overpayment

4

CREDIT FORWARD

5. Overpayment to be credited forward and applied to 2012 estimated tax

5

6. Overpayment donation:

6a.

American flags for veterans' graves in Grand Rapids

6a

All or any portion of

6b.

Grand Rapids Children's Fund

6b

overpayment may be

6c.

Grand Rapids Parks' Fund

donated to any fund.

6c

REFUND

7. Refund. For direct deposit refund mark (X) box on line 8 and complete lines 8 a, b & c. (Line 4 less lines 5, 6a, 6b and 6c)

7

8. Mark one:

Refund - Direct Deposit

Pay tax due - Electronic funds withdrawal

ELECTRONIC

REFUND OR

8a. Routing number

PAYMENT DATA

8b. Account number

8c. Account type:

Checking

Savings

9. May the Income Tax Office discuss this return with the preparer shown below?

Yes

No

I declare that I have examined this return (including accompanying schedules) and to the best of my knowledge and belief, it is true, correct and complete.

If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has any knowledge.

-

(

)

(Date)

(Signature of partner or member)

(Title)

(Phone number)

-

(

)

(Date)

(Preparer's signature)

(Firm name and address)

(Phone number)

MAIL TO: GRAND RAPIDS INCOME TAX DEPARTMENT, PO BOX 109, GRAND RAPIDS, MICHIGAN 49501-0109

2011 GR-1065 Page 1 Revised: 02/24/2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3