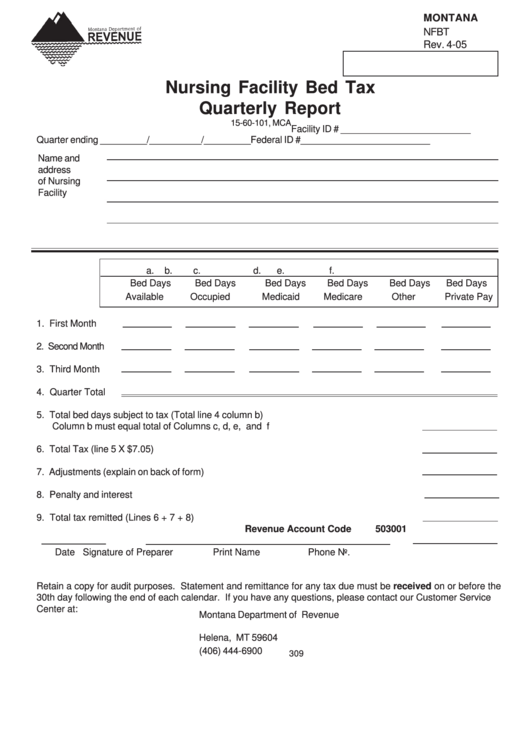

Form Nfbt - Nursing Facility Bed Tax Quarterly Report Form - Montana Department Of Revenue

ADVERTISEMENT

MONTANA

NFBT

Rev. 4-05

Nursing Facility Bed Tax

Quarterly Report

15-60-101, MCA

Facility ID # _________________________

Quarter ending _________/__________/_________

Federal ID #_________________________

Name and

address

of Nursing

Facility

a.

b.

c.

d.

e.

f.

Bed Days

Bed Days

Bed Days

Bed Days

Bed Days

Bed Days

Available

Occupied

Medicaid

Medicare

Other

Private Pay

1. First Month

2. Second Month

3. Third Month

4. Quarter Total

5. Total bed days subject to tax (Total line 4 column b)

Column b must equal total of Columns c, d, e, and f

6. Total Tax (line 5 X $7.05)

7. Adjustments (explain on back of form)

8. Penalty and interest

9. Total tax remitted (Lines 6 + 7 + 8)

Revenue Account Code

503001

Date

Signature of Preparer

Print Name

Phone No.

Retain a copy for audit purposes. Statement and remittance for any tax due must be received on or before the

30th day following the end of each calendar. If you have any questions, please contact our Customer Service

Center at:

Montana Department of Revenue

P.O. Box 5835

Helena, MT 59604

(406) 444-6900

309

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1