Form 62a601 - Foreign Savings And Loan Tax Return

ADVERTISEMENT

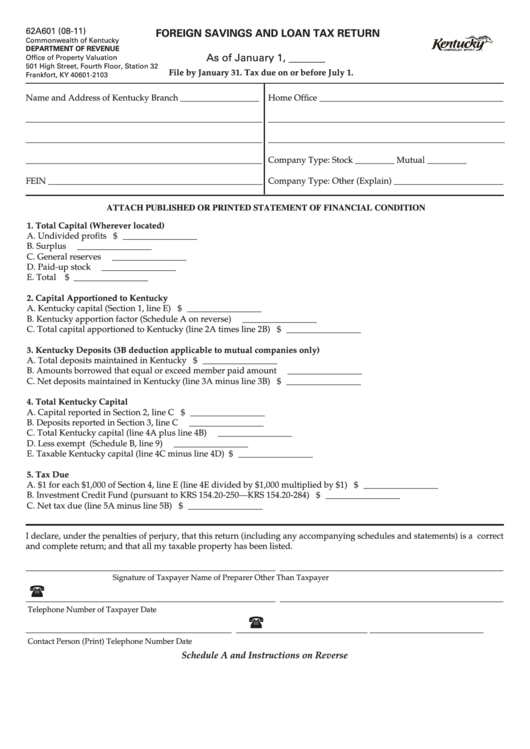

62A601 (08-11)

FOREIGN SAVINGS AND LOAN TAX RETURN

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

As of January 1, _______

Office of Property Valuation

501 High Street, Fourth Floor, Station 32

File by January 31. Tax due on or before July 1.

Frankfort, KY 40601-2103

Name and Address of Kentucky Branch __________________

Home Office __________________________________________

______________________________________________________

______________________________________________________

______________________________________________________

______________________________________________________

______________________________________________________

Company Type: Stock _________ Mutual _________

FEIN _________________________________________________

Company Type: Other (Explain) _________________________

AttAch Published or Printed stAtement of finAnciAl condition

1.

Total Capital (Wherever located)

A. Undivided profits ....................................................................................... $ _________________

B. Surplus .........................................................................................................

_________________

C. General reserves .........................................................................................

_________________

D. Paid-up stock ..............................................................................................

_________________

E. Total ........................................................................................................................................................

$ _________________

2.

Capital Apportioned to Kentucky

A. Kentucky capital (Section 1, line E) ......................................................... $ _________________

B. Kentucky apportion factor (Schedule A on reverse) .............................

_________________

C. Total capital apportioned to Kentucky (line 2A times line 2B) ........................................................ $ _________________

3.

Kentucky Deposits (3B deduction applicable to mutual companies only)

A. Total deposits maintained in Kentucky .................................................. $ _________________

B. Amounts borrowed that equal or exceed member paid amount ........

_________________

C. Net deposits maintained in Kentucky (line 3A minus line 3B) ....................................................... $ _________________

4.

Total Kentucky Capital

A. Capital reported in Section 2, line C ........................................................ $ _________________

B. Deposits reported in Section 3, line C .....................................................

_________________

C. Total Kentucky capital (line 4A plus line 4B) .........................................

_________________

D. Less exempt U.S. government securities (Schedule B, line 9) ..............

_________________

E. Taxable Kentucky capital (line 4C minus line 4D)............................................................................. $ _________________

5.

Tax Due

A. $1 for each $1,000 of Section 4, line E (line 4E divided by $1,000 multiplied by $1) .................... $ _________________

B. Investment Credit Fund (pursuant to KRS 154.20-250—KRS 154.20-284) ..................................... $ _________________

C. Net tax due (line 5A minus line 5B) ..................................................................................................... $ _________________

I declare, under the penalties of perjury, that this return (including any accompanying schedules and statements) is a correct

and complete return; and that all my taxable property has been listed.

_________________________________________________________ ___________________________________________________

Signature of Taxpayer

Name of Preparer Other Than Taxpayer

_________________________________________________________ ___________________________________________________

Telephone Number of Taxpayer

Date

_______________________________________________

______________________________

__________________________

Contact Person (Print)

Telephone Number

Date

Schedule A and Instructions on Reverse

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2