Clear

Print

l

2008

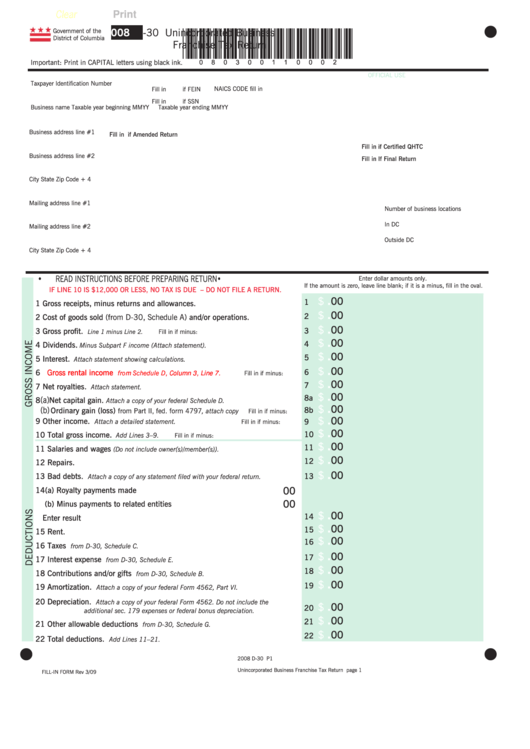

D-30 Unincorporated Business

government of the

*080300110002*

District of Columbia

Franchise tax Return

Important: Print in CaPItaL letters using black ink.

oFFICIaL Use

taxpayer Identification Number

NaICs CoDe fill in

Fill in

if FeIN

Fill in

if ssN

Business name

taxable year beginning mmYY

taxable year ending mmYY

Business address line #1

Fill in

if Amended Return

Fill in

if Certified QHTC

Business address line #2

Fill in

If Final Return

City

state

Zip Code + 4

mailing address line #1

Number of business locations

In DC

mailing address line #2

outside DC

City

state

Zip Code + 4

•ReaD INstRUCtIoNs BeFoRe PRePaRINg RetURN•

enter dollar amounts only.

If the amount is zero, leave line blank; if it is a minus, fill in the oval.

IF LINE 10 IS $12,000 OR LESS, NO TAX IS DUE – DO NOT FILE A RETURN.

.

$

00

1

1

Gross receipts, minus returns and allowances.

.

00

$

2

2

Cost of goods sold (from D-30, schedule a) and/or operations.

.

$

00

3

3

Gross profit.

Line 1 minus Line 2.

Fill in if minus:

.

$

00

4

4

Dividends.

Minus Subpart F income (Attach statement).

.

$

00

5

5

Interest.

Attach statement showing calculations.

.

$

00

6

6

Gross rental income

from Schedule D, Column 3, Line 7.

Fill in if minus:

.

$

00

7

7

Net royalties.

Attach statement.

.

$

00

8a

(a)

8

Net capital gain.

Attach a copy of your federal Schedule D.

.

$

00

(b)

Ordinary gain (loss)

8b

from Part II, fed. form 4797 , attach copy

Fill in if minus:

.

$

00

9

Other income.

9

Attach a detailed statement.

Fill in if minus:

.

00

$

10

10 Total gross income.

Add Lines 3–9.

Fill in if minus:

.

$

00

11

11 Salaries and wages

(Do not include owner(s)/member(s)).

.

$

00

12

12 Repairs.

.

$

00

13

13 Bad debts.

Attach a copy of any statement filed with your federal return.

.

00

14(a) Royalty payments made

.

00

(b) Minus payments to related entities

.

$

00

14

Enter result

.

$

00

15

15 Rent.

.

$

00

16

16 Taxes

from D-30, Schedule C.

.

$

00

17

17 Interest expense

from D-30, Schedule E.

.

$

00

18

18 Contributions and/or gifts

from D-30, Schedule B.

.

$

00

19

19 Amortization.

Attach a copy of your federal Form 4562, Part VI.

20 Depreciation.

Attach a copy of your federal Form 4562. Do not include the

.

$

00

20

additional sec. 179 expenses or federal bonus depreciation.

.

$

00

21

21 Other allowable deductions

from D-30, Schedule G.

.

$

00

22

22 Total deductions.

Add Lines 11–21.

l

l

2008 D-30 P1

Unincorporated Business Franchise tax Return page 1

FILL-IN FORM Rev 3/09

1

1 2

2 3

3 4

4 5

5