Irs Publication 1544 - Reporting Cash Payments - 2012 Page 4

ADVERTISEMENT

By May 27, you must file an additional Form

2. The amount of cash you received and

security number, your filing status, and the

8300 for the additional payments that total

were required to report (up to $100,000).

exact whole dollar amount of your refund.

$15,000.

Efile your return. Find out about commer

There are criminal penalties for:

cial tax preparation and efile services

Willful failure to file Form 8300,

Amending a Report? If you are amending a

available free to eligible taxpayers.

Willfully filing a false or fraudulent Form

report, check box 1a at the top of Form 8300.

Download forms, including talking tax

8300,

Complete the form in its entirety (Parts IIV) and

forms, instructions, and publications.

Stopping or trying to stop Form 8300 from

include the amended information. Do not attach

Order IRS products online.

being filed, and

a copy of the original report.

Research your tax questions online.

Setting up, helping to set up, or trying to

Search publications online by topic or key

set up a transaction in a way that would

Where to file. Mail the form to the address

word.

make it seem unnecessary to file Form

given in the Form 8300 instructions.

Use the online Internal Revenue Code,

8300.

regulations, or other official guidance.

Required statement to buyer. You must give

If you willfully fail to file Form 8300, you can

View Internal Revenue Bulletins (IRBs)

a written or electronic statement to each person

be fined up to $250,000 for individuals

published in the last few years.

named on any Form 8300 you must file. You

($500,000 for corporations) or sentenced to up

Figure your withholding allowances using

can give the statement electronically only if the

to 5 years in prison, or both. These dollar

the withholding calculator online at

recipient agrees to receive it in that format. The

amounts are based on Section 3571 of Title 18

statement must show the name and address of

of the U.S. Code.

Determine if Form 6251 must be filed by

your business, the name and phone number of

using our Alternative Minimum Tax (AMT)

a contact person, and the total amount of re

The penalties for failure to file may also ap

Assistant available online at

portable cash you received from the person

ply to any person (including a payer) who at

during the year. It must state that you are also

tempts to interfere with or prevent the seller (or

Sign up to receive local and national tax

reporting this information to the IRS.

business) from filing a correct Form 8300. This

news by email.

You must send this statement to the buyer

includes any attempt to structure the transac

Get information on starting and operating a

by January 31 of the year after the year in which

tion in a way that would make it seem unneces

small business.

you received the cash that caused you to file

sary to file Form 8300. Structuring means

the form.

breaking up a large cash transaction into small

Phone. Many services are available

cash transactions.

You must keep a copy of every Form

by phone.

8300 you file for 5 years.

How To Get Tax Help

Ordering forms, instructions, and publica

RECORDS

tions. Call 1800TAXFORM

(18008293676) to order currentyear

You can get help with unresolved tax issues, or

Examples

forms, instructions, and publications, and

der free publications and forms, ask tax ques

prioryear forms and instructions. You

tions, and get information from the IRS in sev

should receive your order within 10 days.

Example 1. Pat Brown is the sales man

eral ways. By selecting the method that is best

Asking tax questions. Call the IRS with

ager for Small Town Cars. On January 6, 2009,

for you, you will have quick and easy access to

your tax questions at 18008291040.

Jane Smith buys a new car from Pat and pays

tax help.

Solving problems. You can get

$18,000 in cash. Pat asks for identification from

facetoface help solving tax problems ev

Jane to get the necessary information to com

Free help with your return. Free help in pre

ery business day in IRS Taxpayer Assis

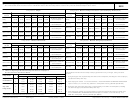

plete Form 8300. A filledin form is shown in this

paring your return is available nationwide from

tance Centers. An employee can explain

publication.

IRScertified volunteers. The Volunteer Income

IRS letters, request adjustments to your

Pat must mail the form to the address shown

Tax Assistance (VITA) program is designed to

account, or help you set up a payment

in the form's instructions by January 21, 2009.

help lowmoderate income taxpayers and the

plan. Call your local Taxpayer Assistance

He must also send a statement to Jane by Jan

Tax Counseling for the Elderly (TCE) program

Center for an appointment. To find the

uary 31, 2010.

is designed to assist taxpayers age 60 and

number, go to

older with their tax returns. Most VITA and TCE

or look in the phone book under United

Example 2. Using the same facts given in

sites offer free electronic filing and all volun

States Government, Internal Revenue

Example 1, suppose Jane had arranged to

teers will let you know about credits and deduc

Service.

make cash payments of $6,000 each on Janu

tions you may be entitled to claim. To find the

TTY/TDD equipment. If you have access to

ary 6, February 6, and March 6. Pat would have

nearest VITA or TCE site, visit IRS.gov or call

TTY/TDD equipment, call 18008294059

to file a Form 8300 by February 26 (17 days af

18009069887 or 18008291040.

to ask tax questions or to order forms and

ter receiving total cash payments within 1 year

As part of the TCE program, AARP offers

publications.

over $10,000 because February 21, 2009, is a

the TaxAide counseling program. To find the

TeleTax topics. Call 18008294477 to lis

Saturday). Pat would not have to report the re

nearest

AARP

TaxAide

site,

call

ten to prerecorded messages covering

maining $6,000 cash payment because it is not

18882277669 or visit AARP's website at

various tax topics.

more than $10,000. However, he could report it

Refund information. You can check the

if he felt it was a suspicious transaction.

For more information on these programs, go

status of your refund on the new IRS

to IRS.gov and enter keyword “VITA” in the up

phone app. Download the free IRS2Go

per righthand corner.

Penalties

app by visiting the iTunes app store or the

Android Marketplace. IRS2Go is a new

Internet. You can access the IRS

way to provide you with information and

website at IRS.gov 24 hours a day, 7

There are civil penalties for failure to:

tools. To check the status of your refund by

days a week to:

File a correct Form 8300 by the date it is

Check the status of your 2011 refund. Go

phone, call 18008294477 (automated

due, and

to IRS.gov and click on Where's My Re

refund information 24 hours a day, 7 days

Provide the required statement to those

fund. Wait at least 72 hours after the IRS

a week). Wait at least 72 hours after the

named in the Form 8300.

acknowledges receipt of your efiled re

IRS acknowledges receipt of your efiled

turn, or 3 to 4 weeks after mailing a paper

return, or 3 to 4 weeks after mailing a pa

If you intentionally disregard the requirement

return. If you filed Form 8379 with your re

per return. If you filed Form 8379 with your

to file a correct Form 8300 by the date it is due,

return, wait 14 weeks (11 weeks if you filed

turn, wait 14 weeks (11 weeks if you filed

the penalty is the greater of:

electronically). Have your 2011 tax return

electronically). Have your 2011 tax return

1. $25,000, or

available so you can provide your social

available so you can provide your social

Page 4

Publication 1544 (September 2012)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6