Form 51a291 - Application For Kentucky Signature Project Sales And Use Tax Refund

ADVERTISEMENT

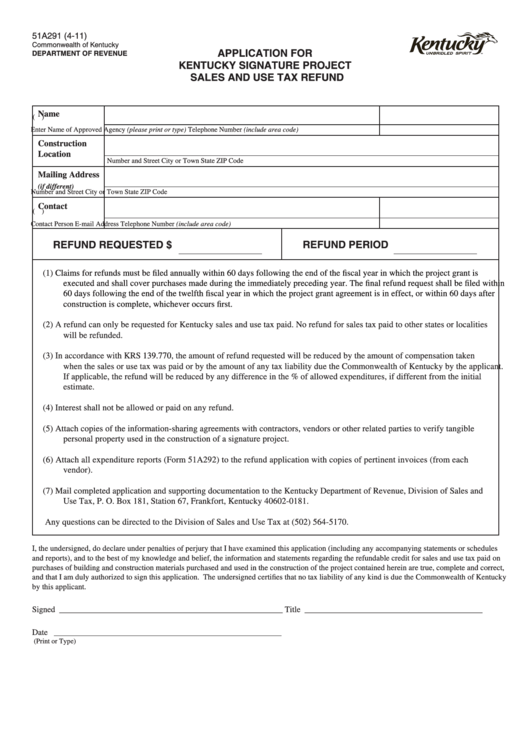

51A291 (4-11)

Commonwealth of Kentucky

APPLICATION FOR

DEPARTMENT OF REVENUE

KENTUCKY SIGNATURE PROJECT

SALES AND USE TAX REFUND

Name

(

)

Enter Name of Approved Agency (please print or type)

Telephone Number (include area code)

Construction

Location

Number and Street

City or Town

State

ZIP Code

Mailing Address

(if different)

Number and Street

City or Town

State

ZIP Code

Contact

(

)

Contact Person

E-mail Address

Telephone Number (include area code)

REFUND REQUESTED $

REFUND PERIOD

(1)

Claims for refunds must be filed annually within 60 days following the end of the fiscal year in which the project grant is

executed and shall cover purchases made during the immediately preceding year. The final refund request shall be filed within

60 days following the end of the twelfth fiscal year in which the project grant agreement is in effect, or within 60 days after

construction is complete, whichever occurs first.

(2)

A refund can only be requested for Kentucky sales and use tax paid. No refund for sales tax paid to other states or localities

will be refunded.

(3)

In accordance with KRS 139.770, the amount of refund requested will be reduced by the amount of compensation taken

when the sales or use tax was paid or by the amount of any tax liability due the Commonwealth of Kentucky by the applicant.

If applicable, the refund will be reduced by any difference in the % of allowed expenditures, if different from the initial

estimate.

(4)

Interest shall not be allowed or paid on any refund.

(5)

Attach copies of the information-sharing agreements with contractors, vendors or other related parties to verify tangible

personal property used in the construction of a signature project.

(6)

Attach all expenditure reports (Form 51A292) to the refund application with copies of pertinent invoices (from each

vendor).

(7)

Mail completed application and supporting documentation to the Kentucky Department of Revenue, Division of Sales and

Use Tax, P. O. Box 181, Station 67, Frankfort, Kentucky 40602-0181.

Any questions can be directed to the Division of Sales and Use Tax at (502) 564-5170.

I, the undersigned, do declare under penalties of perjury that I have examined this application (including any accompanying statements or schedules

and reports), and to the best of my knowledge and belief, the information and statements regarding the refundable credit for sales and use tax paid on

purchases of building and construction materials purchased and used in the construction of the project contained herein are true, complete and correct,

and that I am duly authorized to sign this application. The undersigned certifies that no tax liability of any kind is due the Commonwealth of Kentucky

by this applicant.

Signed ______________________________________________________

Title ___________________________________________

Date _______________________________________________________

(Print or Type)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1