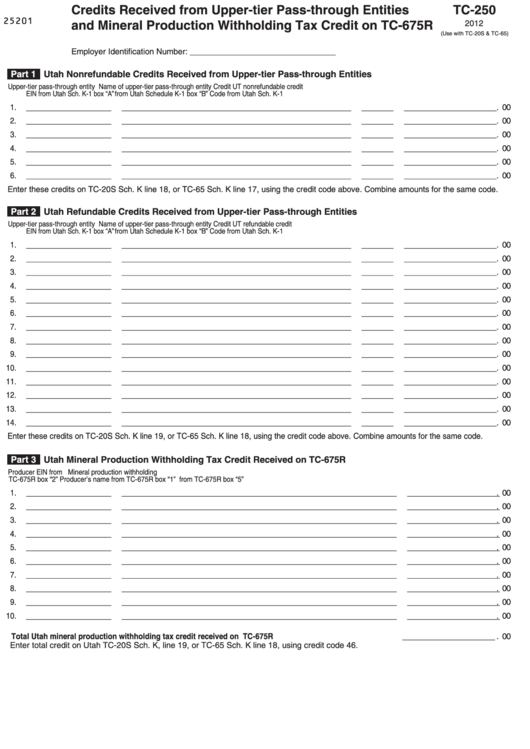

Credits Received from Upper-tier Pass-through Entities

TC-250

25201

and Mineral Production Withholding Tax Credit on TC-675R

2012

(Use with TC-20S & TC-65)

Employer Identification Number: _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Part 1

Utah Nonrefundable Credits Received from Upper-tier Pass-through Entities

Upper-tier pass-through entity Name of upper-tier pass-through entity

Credit

UT nonrefundable credit

EIN from Utah Sch. K-1 box “A” from Utah Schedule K-1 box “B”

Code

from Utah Sch. K-1

1.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

2.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

3.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

4.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

5.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

6.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

Enter these credits on TC-20S Sch. K line 18, or TC-65 Sch. K line 17, using the credit code above. Combine amounts for the same code.

Part 2

Utah Refundable Credits Received from Upper-tier Pass-through Entities

Upper-tier pass-through entity Name of upper-tier pass-through entity

Credit

UT refundable credit

EIN from Utah Sch. K-1 box “A” from Utah Schedule K-1 box “B”

Code

from Utah Sch. K-1

1.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

2.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

3.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

4.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

5.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

6.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

7.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

8.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

9.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

10.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

11.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

12.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

13.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

14.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

Enter these credits on TC-20S Sch. K line 19, or TC-65 Sch. K line 18, using the credit code above. Combine amounts for the same code.

Part 3

Utah Mineral Production Withholding Tax Credit Received on TC-675R

Producer EIN from

Mineral production withholding

TC-675R box “2”

Producer’s name from TC-675R box “1”

from TC-675R box “5”

1.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

2.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

3.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

4.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

5.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

6.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

7.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

8.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

9.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

10.

_ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ . 00

Total Utah mineral production withholding tax credit received on TC-675R....................................................

_ _ _ _ _ _ _ _ _ _ _ _ . 00

Enter total credit on Utah TC-20S Sch. K, line 19, or TC-65 Sch. K line 18, using credit code 46.

1

1