Tab to navigate throughout form.

Save

Print

Clear

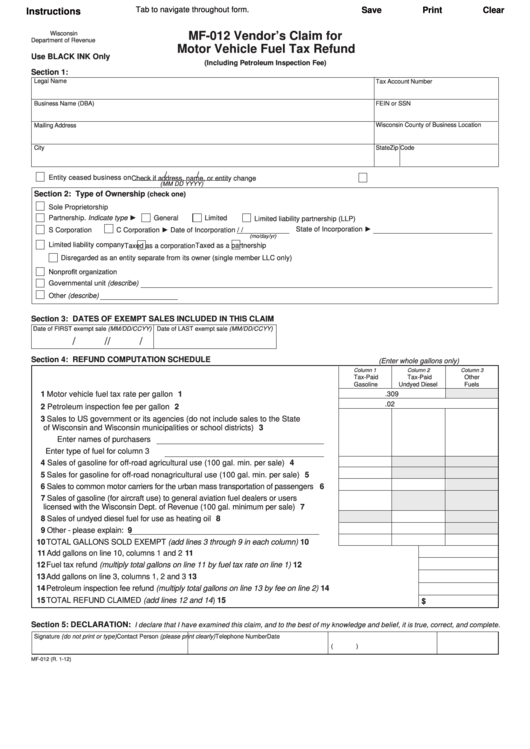

Instructions

Wisconsin

MF-012 Vendor’s Claim for

Department of Revenue

Motor Vehicle Fuel Tax Refund

Use BLACK INK Only

(Including Petroleum Inspection Fee)

Section 1:

Legal Name

Tax Account Number

Business Name (DBA)

FEIN or SSN

Wisconsin County of Business Location

Mailing Address

City

State

Zip Code

/

/

Entity ceased business on

Check if address, name, or entity change

(MM DD YYYY)

Section 2: Type of Ownership

(check one)

Sole Proprietorship

Partnership. Indicate type ►

General

Limited

Limited liability partnership (LLP)

State of Incorporation ►

C Corporation ► Date of Incorporation

S Corporation

/

/

(mo/day/yr)

Limited liability company

Taxed as a corporation

Taxed as a partnership

Disregarded as an entity separate from its owner (single member LLC only)

Nonprofit organization

Governmental unit (describe)

Other (describe)

Section 3: DATES OF EXEMPT SALES INCLUDED IN THIS CLAIM

Date of FIRST exempt sale (MM/DD/CCYY) Date of LAST exempt sale (MM/DD/CCYY)

/

/

/

/

Section 4: REFUND COMPUTATION SCHEDULE

(Enter whole gallons only)

Column 1

Column 2

Column 3

Tax-Paid

Tax-Paid

Other

Gasoline

Undyed Diesel

Fuels

1 Motor vehicle fuel tax rate per gallon . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

.309

.02

2 Petroleum inspection fee per gallon . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Sales to US government or its agencies (do not include sales to the State

of Wisconsin and Wisconsin municipalities or school districts) . . . . . . . . . . . . . . 3

Enter names of purchasers

Enter type of fuel for column 3

4 Sales of gasoline for off-road agricultural use (100 gal. min. per sale) . . . . . . . . 4

5 Sales for gasoline for off-road nonagricultural use (100 gal. min. per sale) . . . . 5

6 Sales to common motor carriers for the urban mass transportation of passengers

6

7 Sales of gasoline (for aircraft use) to general aviation fuel dealers or users

licensed with the Wisconsin Dept. of Revenue (100 gal. minimum per sale) . . . . 7

8 Sales of undyed diesel fuel for use as heating oil . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Other - please explain:

9

10 TOTAL GALLONS SOLD EXEMPT (add lines 3 through 9 in each column) . . . . 10

11 Add gallons on line 10, columns 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Fuel tax refund (multiply total gallons on line 11 by fuel tax rate on line 1) . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Add gallons on line 3, columns 1, 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Petroleum inspection fee refund (multiply total gallons on line 13 by fee on line 2) . . . . . . . . . . . . . . . . . . 14

15 TOTAL REFUND CLAIMED (add lines 12 and 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

$

Section 5: DECLARATION:

I declare that I have examined this claim, and to the best of my knowledge and belief, it is true, correct, and complete.

Signature (do not print or type)

Contact Person (please print clearly)

Telephone Number

Date

(

)

MF-012 (R. 1-12)

1

1