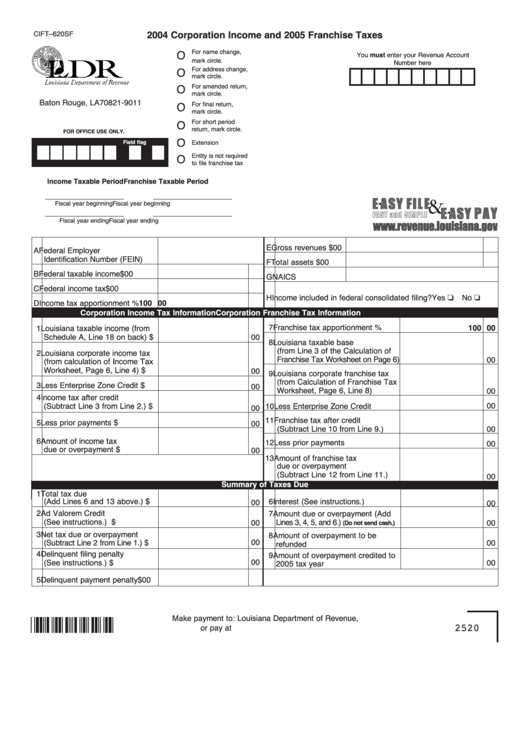

CIFT–620SF

2004 Corporation Income and 2005 Franchise Taxes

For name change,

O

You must enter your Revenue Account

mark circle.

Number here

For address change,

O

mark circle.

For amended return,

O

P.O. Box 91011

mark circle.

Baton Rouge, LA 70821-9011

For final return,

O

mark circle.

For short period

O

return, mark circle.

FOR OFFICE USE ONLY.

O

Field flag

Extension

Entity is not required

O

to file franchise tax

Income Taxable Period

Franchise Taxable Period

Fiscal year beginning

Fiscal year beginning

Fiscal year ending

Fiscal year ending

E Gross revenues

$

00

A Federal Employer

Identification Number (FEIN)

F Total assets

$

00

B Federal taxable income

$

00

G NAICS

C Federal income tax

$

00

H Income included in federal consolidated filing? Yes J

No J

D Income tax apportionment %

100 00

Corporation Income Tax Information

Corporation Franchise Tax Information

7 Franchise tax apportionment %

100

00

1 Louisiana taxable income (from

Schedule A, Line 18 on back)

$

00

8 Louisiana taxable base

(from Line 3 of the Calculation of

2 Louisiana corporate income tax

Franchise Tax Worksheet on Page 6)

00

(from calculation of Income Tax

Worksheet, Page 6, Line 4)

$

00

9 Louisiana corporate franchise tax

(from Calculation of Franchise Tax

3 Less Enterprise Zone Credit

$

00

Worksheet, Page 6, Line 8)

00

4 Income tax after credit

(Subtract Line 3 from Line 2.)

$

00

10 Less Enterprise Zone Credit

00

11 Franchise tax after credit

5 Less prior payments

$

00

(Subtract Line 10 from Line 9.)

00

6 Amount of income tax

12 Less prior payments

00

due or overpayment

$

00

13 Amount of franchise tax

due or overpayment

(Subtract Line 12 from Line 11.)

00

Summary of Taxes Due

1 Total tax due

(Add Lines 6 and 13 above.)

$

6 Interest (See instructions.)

00

00

2 Ad Valorem Credit

7 Amount due or overpayment (Add

(See instructions.)

$

00

Lines 3, 4, 5, and 6.)

00

(Do not send cash.)

3 Net tax due or overpayment

8 Amount of overpayment to be

00

(Subtract Line 2 from Line 1.)

$

00

refunded

4 Delinquent filing penalty

9 Amount of overpayment credited to

(See instructions.)

$

00

00

2005 tax year

5 Delinquent payment penalty

$

00

Make payment to: Louisiana Department of Revenue,

or pay at

2520

1

1 2

2