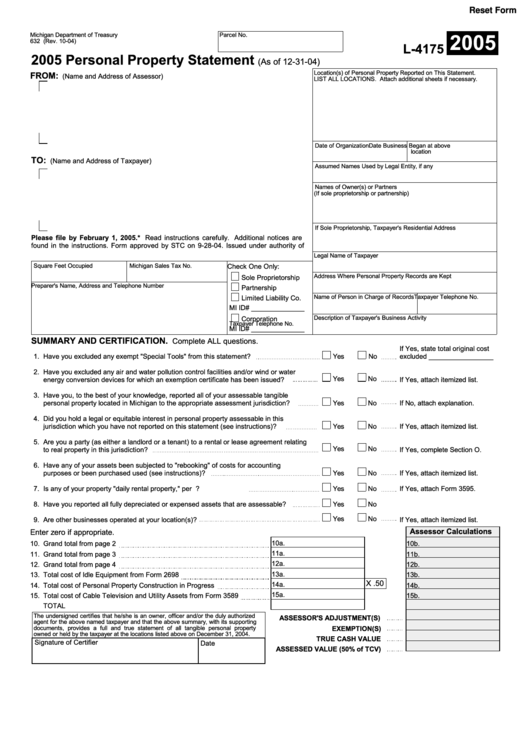

Reset Form

Michigan Department of Treasury

Parcel No.

2005

632 (Rev. 10-04)

L-4175

2005 Personal Property Statement

(As of 12-31-04)

Location(s) of Personal Property Reported on This Statement.

FROM:

(Name and Address of Assessor)

LIST ALL LOCATIONS. Attach additional sheets if necessary.

Date of Organization

Date Business Began at above

location

TO:

(Name and Address of Taxpayer)

Assumed Names Used by Legal Entity, if any

Names of Owner(s) or Partners

(If sole proprietorship or partnership)

If Sole Proprietorship, Taxpayer's Residential Address

Please file by February 1, 2005.* Read instructions carefully. Additional notices are

found in the instructions. Form approved by STC on 9-28-04. Issued under authority of

P.A. 206 of 1893.

Legal Name of Taxpayer

Square Feet Occupied

Michigan Sales Tax No.

Check One Only:

Address Where Personal Property Records are Kept

Sole Proprietorship

Preparer's Name, Address and Telephone Number

Partnership

Name of Person in Charge of Records

Taxpayer Telephone No.

Limited Liability Co.

MI ID# ______________

Description of Taxpayer's Business Activity

Corporation

Taxpayer Telephone No.

MI ID# ______________

SUMMARY AND CERTIFICATION.

Complete ALL questions.

If Yes, state total original cost

1.

Have you excluded any exempt "Special Tools" from this statement?

Yes

No

excluded _________________

2.

Have you excluded any air and water pollution control facilities and/or wind or water

Yes

No

energy conversion devices for which an exemption certificate has been issued?

If Yes, attach itemized list.

3.

Have you, to the best of your knowledge, reported all of your assessable tangible

personal property located in Michigan to the appropriate assessment jurisdiction?

Yes

No

If No, attach explanation.

4.

Did you hold a legal or equitable interest in personal property assessable in this

jurisdiction which you have not reported on this statement (see instructions)?

Yes

No

If Yes, attach itemized list.

5.

Are you a party (as either a landlord or a tenant) to a rental or lease agreement relating

Yes

No

to real property in this jurisdiction?

If Yes, complete Section O.

6.

Have any of your assets been subjected to "rebooking" of costs for accounting

purposes or been purchased used (see instructions)?

Yes

No

If Yes, attach itemized list.

7.

Is any of your property "daily rental property," per P.A. 537 of 1998?

Yes

No

If Yes, attach Form 3595.

8.

Have you reported all fully depreciated or expensed assets that are assessable?

Yes

No

Yes

No

9.

Are other businesses operated at your location(s)?

If Yes, attach itemized list.

Assessor Calculations

Enter zero if appropriate.

10a.

10.

Grand total from page 2

10b.

11a.

11.

Grand total from page 3

11b.

12a.

12.

Grand total from page 4

12b.

13a.

13.

Total cost of Idle Equipment from Form 2698

13b.

X .50

14a.

14.

Total cost of Personal Property Construction in Progress

14b.

15a.

15.

Total cost of Cable Television and Utility Assets from Form 3589

15b.

TOTAL ...........................

The undersigned certifies that he/she is an owner, officer and/or the duly authorized

ASSESSOR'S ADJUSTMENT(S)

agent for the above named taxpayer and that the above summary, with its supporting

documents, provides a full and true statement of all tangible personal property

EXEMPTION(S)

owned or held by the taxpayer at the locations listed above on December 31, 2004.

TRUE CASH VALUE

Signature of Certifier

Date

ASSESSED VALUE (50% of TCV)

1

1 2

2 3

3 4

4