City Income Tax Withheld For The Tax Year - City Of Gallipolis, Ohio

ADVERTISEMENT

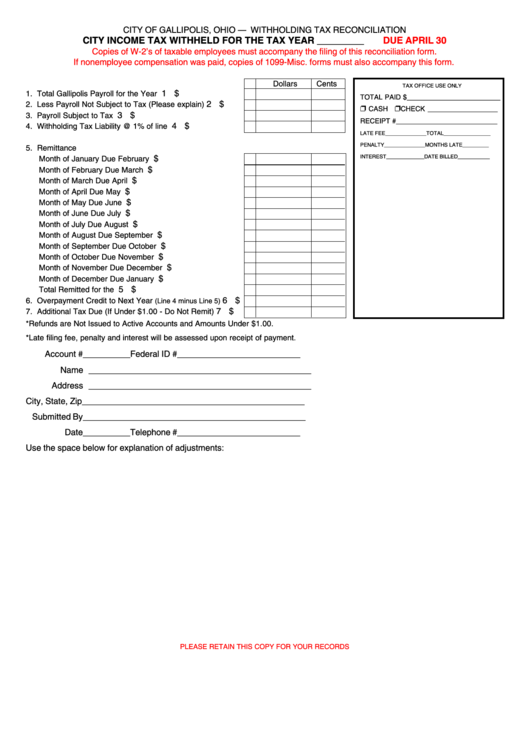

CITY OF GALLIPOLIS, OHIO — WITHHOLDING TAX RECONCILIATION

CITY INCOME TAX WITHHELD FOR THE TAX YEAR _________

DUE APRIL 30

Copies of W-2’s of taxable employees must accompany the filing of this reconciliation form.

If nonemployee compensation was paid, copies of 1099-Misc. forms must also accompany this form.

Dollars

Cents

TAX OFFICE USE ONLY

1 $

1. Total Gallipolis Payroll for the Year ..................................

TOTAL PAID $ ________________________

2 $

2. Less Payroll Not Subject to Tax (Please explain) ............

CASH

CHECK __________________

3 $

3. Payroll Subject to Tax ......................................................

RECEIPT # __________________________

4 $

4. Withholding Tax Liability @ 1% of line 3 ..........................

LATE FEE ______________ TOTAL ________________

PENALTY ______________ MONTHS LATE _________

5. Remittance

INTEREST _____________ DATE BILLED ___________

$

Month of January Due February 28 ...................................

$

Month of February Due March 31 ......................................

$

Month of March Due April 30 .............................................

$

Month of April Due May 31 ................................................

$

Month of May Due June 30 ................................................

$

Month of June Due July 31 ................................................

$

Month of July Due August 31 .............................................

$

Month of August Due September 30 ..................................

$

Month of September Due October 31 ................................

$

Month of October Due November 30 .................................

$

Month of November Due December 31 .............................

$

Month of December Due January 31 .................................

5 $

Total Remitted for the Year .............................................

6 $

6. Overpayment Credit to Next Year

(Line 4 minus Line 5) ......

7 $

7. Additional Tax Due (If Under $1.00 - Do Not Remit) ........

*Refunds are Not Issued to Active Accounts and Amounts Under $1.00.

*Late filing fee, penalty and interest will be assessed upon receipt of payment.

Account # __________ Federal ID # __________________________

Name _______________________________________________

Address _______________________________________________

City, State, Zip _______________________________________________

Submitted By _______________________________________________

Date __________ Telephone # __________________________

Use the space below for explanation of adjustments:

PLEASE RETAIN THIS COPY FOR YOUR RECORDS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1