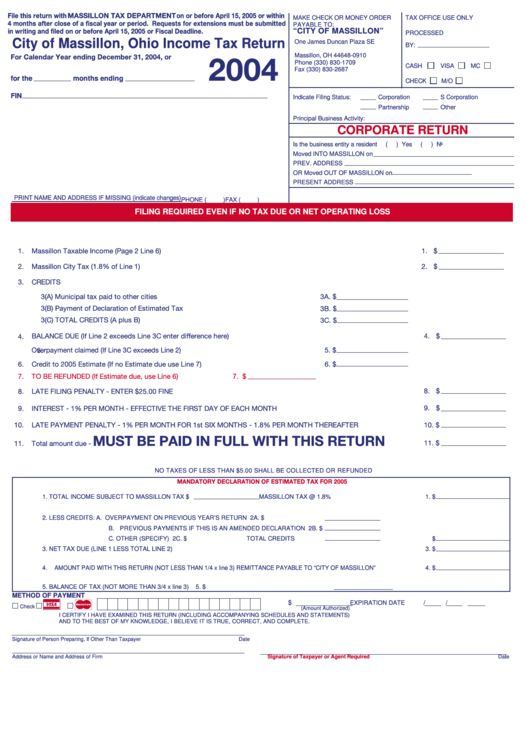

Income Tax Return Form - Massillon Tax Department - 2004

ADVERTISEMENT

File this return with MASSILLON TAX DEPARTMENT on or before April 15, 2005 or within

MAKE CHECK OR MONEY ORDER

TAX OFFICE USE ONLY

4 months after close of a fiscal year or period. Requests for extensions must be submitted

PAYABLE TO:

in writing and filed on or before April 15, 2005 or Fiscal Deadline.

“CITY OF MASSILLON”

PROCESSED

City of Massillon, Ohio Income Tax Return

One James Duncan Plaza SE

BY:

P.O. Box 910

For Calendar Year ending December 31, 2004, or

Massillon, OH 44648-0910

2004

Phone (330) 830-1709

CASH

VISA

MC

Fax (330) 830-2687

for the

months ending

CHECK

M/O

FIN

Indicate Filing Status:

Corporation

S Corporation

Partnership

Other

Principal Business Activity:

CORPORATE RETURN

Is the business entity a resident

(

) Yes

(

) No

Moved INTO MASSILLON on

PREV. ADDRESS

OR Moved OUT OF MASSILLON on

PRESENT ADDRESS

PRINT NAME AND ADDRESS IF MISSING (indicate changes)

PHONE (

)

FAX (

)

FILING REQUIRED EVEN IF NO TAX DUE OR NET OPERATING LOSS

1.

Massillon Taxable Income (Page 2 Line 6)

1. $

2.

Massillon City Tax (1.8% of Line 1)

2. $

3.

CREDITS

3(A) Municipal tax paid to other cities

3A. $

3(B) Payment of Declaration of Estimated Tax

3B. $

3(C) TOTAL CREDITS (A plus B)

3C.$

BALANCE DUE (If Line 2 exceeds Line 3C enter difference here)

4. $

4.

Overpayment claimed (If Line 3C exceeds Line 2)

5.

5. $

6.

Credit to 2005 Estimate (If no Estimate due use Line 7)

6. $

7.

TO BE REFUNDED (If Estimate due, use Line 6)

7. $

8.

LATE FILING PENALTY - ENTER $25.00 FINE

8. $

9.

INTEREST - 1% PER MONTH - EFFECTIVE THE FIRST DAY OF EACH MONTH

9. $

10. $

10.

LATE PAYMENT PENALTY - 1% PER MONTH FOR 1st SIX MONTHS - 1.8% PER MONTH THEREAFTER

MUST BE PAID IN FULL WITH THIS RETURN

11.

Total amount due -

11. $

NO TAXES OF LESS THAN $5.00 SHALL BE COLLECTED OR REFUNDED

MANDATORY DECLARATION OF ESTIMATED TAX FOR 2005

1.

TOTAL INCOME SUBJECT TO MASSILLON TAX $

MASSILLON TAX @ 1.8%

1. $

2.

LESS CREDITS:

A. OVERPAYMENT ON PREVIOUS YEAR’S RETURN

2A. $

B. PREVIOUS PAYMENTS IF THIS IS AN AMENDED DECLARATION

2B. $

C. OTHER (SPECIFY)

2C. $

TOTAL CREDITS

$

3.

NET TAX DUE (LINE 1 LESS TOTAL LINE 2)

3. $

4.

AMOUNT PAID WITH THIS RETURN (NOT LESS THAN 1/4 x line 3) REMITTANCE PAYABLE TO “CITY OF MASSILLON”

4. $

5.

BALANCE OF TAX (NOT MORE THAN 3/4 x line 3)

5. $

METHOD OF PAYMENT

$

EXPIRATION DATE

/

/

®

Check

(Amount Authorized)

I CERTIFY I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS)

AND TO THE BEST OF MY KNOWLEDGE, I BELIEVE IT IS TRUE, CORRECT, AND COMPLETE.

Signature of Person Preparing, If Other Than Taxpayer

Date

Address or Name and Address of Firm

Signature of Taxpayer or Agent Required

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2