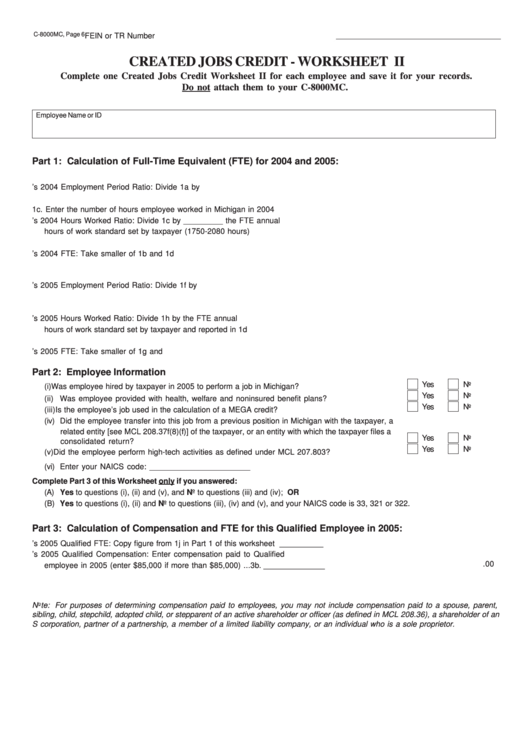

C-8000MC, Page 6

FEIN or TR Number

CREATED JOBS CREDIT - WORKSHEET II

Complete one Created Jobs Credit Worksheet II for each employee and save it for your records.

Do not attach them to your C-8000MC.

Employee Name or ID

Part 1: Calculation of Full-Time Equivalent (FTE) for 2004 and 2005:

1a. Enter the number of weeks employee worked in Michigan in 2004 ............................ 1a. ______________

1b. Employee’s 2004 Employment Period Ratio: Divide 1a by 52 ..................................... 1b. ______________

1c. Enter the number of hours employee worked in Michigan in 2004 ............................. 1c. ______________

1d. Employee’s 2004 Hours Worked Ratio: Divide 1c by _________ the FTE annual

hours of work standard set by taxpayer (1750-2080 hours) ......................................... 1d. ______________

1e. Employee’s 2004 FTE: Take smaller of 1b and 1d ......................................................................................

1e. ______________

1f. Enter the number of weeks employee worked in Michigan in 2005 ............................ 1f. ______________

1g. Employee’s 2005 Employment Period Ratio: Divide 1f by 52 ...................................... 1g. ______________

1h. Enter the number of hours employee worked in Michigan in 2005 ............................. 1h. ______________

1i. Employee’s 2005 Hours Worked Ratio: Divide 1h by the FTE annual

hours of work standard set by taxpayer and reported in 1d above ............................... 1i. ______________

1j. Employee’s 2005 FTE: Take smaller of 1g and 1i ........................................................................................

1j. ______________

Part 2: Employee Information

Yes

No

(i)

Was employee hired by taxpayer in 2005 to perform a job in Michigan? ............................................

Yes

No

(ii) Was employee provided with health, welfare and noninsured benefit plans? ...................................

Yes

No

(iii) Is the employee’s job used in the calculation of a MEGA credit? ........................................................

(iv) Did the employee transfer into this job from a previous position in Michigan with the taxpayer, a

related entity [see MCL 208.37f(8)(f)] of the taxpayer, or an entity with which the taxpayer files a ......

Yes

No

consolidated return? ............................................................................................................................

Yes

No

(v) Did the employee perform high-tech activities as defined under MCL 207.803? ..............................

(vi) Enter your NAICS code: _______________________

Complete Part 3 of this Worksheet only if you answered:

(A) Yes to questions (i), (ii) and (v), and No to questions (iii) and (iv); OR

(B) Yes to questions (i), (ii) and No to questions (iii), (iv) and (v), and your NAICS code is 33, 321 or 322.

Part 3: Calculation of Compensation and FTE for this Qualified Employee in 2005:

3a. Employee’s 2005 Qualified FTE: Copy figure from 1j in Part 1 of this worksheet .......................................

3a. ______________

3b. Employee’s 2005 Qualified Compensation: Enter compensation paid to Qualified

.00

employee in 2005 (enter $85,000 if more than $85,000) .............................................................................

3b. ______________

Note: For purposes of determining compensation paid to employees, you may not include compensation paid to a spouse, parent,

sibling, child, stepchild, adopted child, or stepparent of an active shareholder or officer (as defined in MCL 208.36), a shareholder of an

S corporation, partner of a partnership, a member of a limited liability company, or an individual who is a sole proprietor.

1

1 2

2 3

3 4

4