for an exempt use. If more than 50 percent of the energy is consumed

equipment to irrigate crops is exempt. Propane that is placed in a

for exempt use, the entire billing for that meter is exempt from the

supply tank to heat the farmer’s residence, garage, work shop, and

sales and use tax. However, if it is determined that 50 percent or less

equipment storage buildings is taxable.

of the energy charge through a single meter is consumed for exempt

DEFINITIONS

purposes, an exempt certificate on that meter billing cannot be issued.

Manufacturing and processing is defined as an action or series

The entire charge (qualified and nonqualified use) is taxable.

of actions performed upon tangible personal property, either by hand

The following example illustrates the basis under which the exemption

or machine, which results in that tangible personal property being

is claimed. This example assumes a manufacturing facility with two

reduced or transformed into a different state, quality, form, property,

electric meters and one natural gas meter. Separate billings are issued

or thing. Processing includes grain drying and feed grinding in a

for each meter:

commercial facility, and the freezing of food products. Processing

or manufacturing does not include moving, cleaning, sorting,

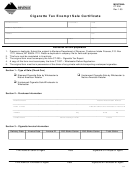

Percent Percent Percent

or repairing property, aerating grain, building erection, cold

Electric Electric Natural

storage of food products, or the preparation of food for immediate

Use

Use

Gas

consumption.

Qualified Area Usage

Meter 1 Meter 2

Use

In addition, energy consumed in heating, cooling, or lighting that portion of

(1) Direct manufacturing

40%

15%

30%

the facility directly used in processing, manufacturing, refining, irrigation,

(2) Production control

10

5

10

or farming, is considered to be for a qualified use.

(3) Product testing

10

10

5

Refining is defined as the action or process of removing impurities

Subtotal

60%

30%

45%

from crude or impure materials, such as glass, metal, sugar, and

Nonqualified Area Usage

petroleum products. Refining includes the extraction of gas and

petroleum products.

(4) Raw materials storage

15%

15%

5%

Irrigation is defined as the application of water to lands for the

(5) Research and development 20

5

10

raising of agricultural crops.

(6) Finished goods storage

15

5

Farming is commercial agriculture, which is the business of

(7) Office and clerical

25

25

producing food products, or other useful and valuable crops, or

(8) Plant maintenance

5

10

10

raising animal life. The crops or animal life can either be sold or

Subtotal

40

70

55

used by the grower. Commercial agriculture includes commercial

TOTAL

100%

100%

100%

production in greenhouses, nurseries, tree farms, sod farms, and

feedlots. Commercial agriculture does not include storage of crops

For purposes of determining the percentage use of exempt energy, only

off the farm or in commercial elevators, or animal life in stockyards

the consumption (direct consumption plus related heating/cooling/

or sale barns. Energy consumed by on-farm grain storage and

lighting) attributable to areas (1), (2), and (3) may be included:

processing is considered to be consumed in farming.

(a) Exempt use of electricity billed through meter #1 is 60%.

Gas is defined as those gases such as natural gas or acetylene that are

(b) Exempt use of electricity billed through meter #2 is 30%.

burned for energy, or oxygen used in welding or cutting metals.

(c) Exempt use of natural gas is 45%.

PROPERLY COMPLETED CERTIFICATE. A purchaser must

properly complete a certificate before issuing it to a seller. To

RESULT:

properly complete the certificate, the purchaser must: (1) identify

Electricity billing (meter #1)

EXEMPT

both purchaser and seller; (2) mark the box for either the “single

Electricity billing (meter #2)

TAXABLE

purchase” or “blanket” indicating whether the certificate is for a single

purchase or is a blanket certificate for future purchases; (3) mark

Natural gas billing

TAXABLE

the appropriate exemption block indicating the category of

For purposes of determining the usage percent, a one-year period

exemption; (4) have the certificate signed by an authorized person;

of consumption will be required. New customers may project their

and (5) indicate the date the certificate was issued.

anticipated consumption.

PENALTIES. Any purchaser, or the agent thereof, who gives

The use of separate energy meters is acceptable for establishing

a Nebraska Energy Source Exempt Sale Certificate, Form 13E,

exemptions within a single facility; however, the taxability of the

to the seller for property which is purchased for a use other than

entire billing for that meter is dependent upon the total energy usage

those enumerated in the Nebraska Revenue Act, as amended, may,

through that meter.

in addition to other penalties, be subject to a penalty of $100 or

ten times the tax, whichever amount is larger, for each instance of

If you checked exemption block B, the purchase and use of energy

presentation and misuse. With regard to a blanket certificate, the

will be exempt from tax when it has been determined that more than

penalty shall apply to each purchase made during the period the

50 percent of the energy purchased is consumed for one or more of

blanket certificate is in effect.

the identified exempt uses. When determining whether more than 50

percent of the energy is consumed for qualified exempt uses, it may

Any purchaser, or the agent thereof, who fraudulently signs a Form 13E

require a separate analysis based on the use of fuel. As an example:

with the intention to avoid payment of the tax may, in addition to the

propane that is placed into a supply tank connected to stationary

aforementioned penalty, be found guilty of a Class IV misdemeanor.

1

1 2

2