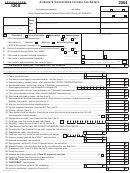

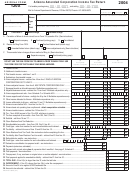

Arizona Form 120x - Arizona Amended Corporation Income Tax Return - 2004 Page 2

ADVERTISEMENT

AZ Form 120X (2004) Page 2

Schedule C - Apportionment Formula (Multistate Corporations Only)

See instruction pages 5 and 6

NOTE: Qualifying air carriers must use Schedule ACA

C1 Property Factor

Column A

Column B

Column C

Value of real and tangible personal property (by averaging the value of

Total

Total Within

Ratio Within

owned property used at the beginning and end of the tax period; rented

Within

and

Arizona

property at capitalized value)

Arizona

Without Arizona

A B

a. Owned property (at original cost):

Inventories ............................................................................................

Depreciable assets ...............................................................................

Land......................................................................................................

Other assets - (describe) ___________________________________

Minus: Construction in progress (if included in above totals) ...............

(

)

(

)

Minus: Nonbusiness property (if included in above totals) ...................

(

)

(

)

Total of section a...................................................................................

b. Rented property (capitalize at 8 times net rental paid) .........................

c. Total owned and rented property (section a total plus section b)..........

C2 Payroll Factor

Total wages, salaries, commissions and other compensation to employees

(per federal Form 1120 or payroll reports) ...................................................

C3 Sales Factor

a. Sales delivered or shipped to Arizona purchasers................................

b. Other gross receipts .............................................................................

c. Total sales and other gross receipts .....................................................

d. Double weight Arizona sales and gross receipts ..................................

X 2

e. Sales factor (for column A - multiply item c by item d; for column B -

enter amount from item c).....................................................................

C4 Total ratio - add C1(c), C2 and C3(e) in column C ............................................................................................................................

C5 Average apportionment ratio - divide C4 by four (4). Enter the result in column C and on page 1, line 9(c) ..................................

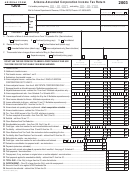

Schedule D - Schedule of Payments (List payment date and amount).

1

Payment with original return _______________________________

2

Payment after original return fi led

3

Payment after original return fi led ___________________________

4

Total - add lines 1, 2 and 3

Schedule E - Explanation of Changes (See instruction page 6)

Certifi cation

The following certifi cation must be signed by one or more of the following offi cers (president, treasurer, or any other principal offi cer).

Under penalties of perjury, I (we), the undersigned offi cer(s) authorized to sign this return, declare that I (we) have examined this return, including the

accompanying schedules and statements, and to the best of my (our) knowledge and belief, it is a true, correct and complete return, made in good faith, for

the taxable year stated pursuant to the income tax laws of the State of Arizona.

Please

Offi cer’s signature

Title

Date

Sign

Here

Offi cer’s signature

Title

Date

Paid

Preparer’s signature

Date

Preparer’s

Use Only

Firm’s name (or preparer’s, if self-employed)

Preparer’s TIN

Firm’s address

Zip code

ADOR 91-0029 (04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2