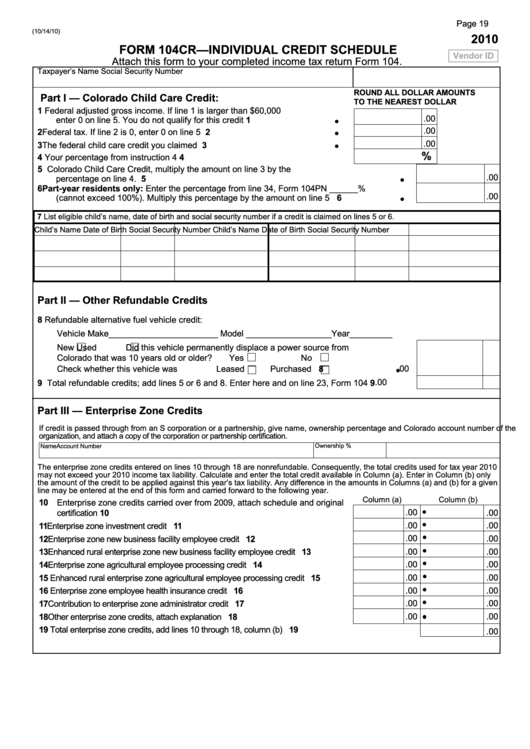

Form 104cr - Individual Credit Schedule - 2010

ADVERTISEMENT

Page 19

(10/14/10)

2010

FORM 104CR—INDIVIDUAL CREDIT SCHEDULE

Vendor ID

Attach this form to your completed income tax return Form 104.

Taxpayer’s Name

Social Security Number

ROUND ALL DOLLAR AMOUNTS

Part I — Colorado Child Care Credit:

TO THE NEAREST DOLLAR

1

Federal adjusted gross income. If line 1 is larger than $60,000

.00

enter 0 on line 5. You do not qualify for this credit .....................................

1

.00

2

Federal tax. If line 2 is 0, enter 0 on line 5 .................................................

2

.00

3

The federal child care credit you claimed ..................................................

3

%

4

Your percentage from instruction 4 .............................................................. 4

5

Colorado Child Care Credit, multiply the amount on line 3 by the

.00

percentage on line 4. ............................................................................................................. 5

6

Part-year residents only: Enter the percentage from line 34, Form 104PN ______%

.00

(cannot exceed 100%). Multiply this percentage by the amount on line 5 ............................. 6

7 List eligible child’s name, date of birth and social security number if a credit is claimed on lines 5 or 6.

Child’s Name

Date of Birth

Social Security Number

Child’s Name

Date of Birth

Social Security Number

Part II — Other Refundable Credits

8

Refundable alternative fuel vehicle credit:

Vehicle Make_______________________ Model __________________Year_________

New

Used

Did this vehicle permanently displace a power source from

Colorado that was 10 years old or older?

Yes

No

.00

Check whether this vehicle was

Leased

Purchased

.........................

8

.00

9

Total refundable credits; add lines 5 or 6 and 8. Enter here and on line 23, Form 104 .......... 9

Part III — Enterprise Zone Credits

If credit is passed through from an S corporation or a partnership, give name, ownership percentage and Colorado account number of the

organization, and attach a copy of the corporation or partnership certification.

Ownership %

Name

Account Number

The enterprise zone credits entered on lines 10 through 18 are nonrefundable. Consequently, the total credits used for tax year 2010

may not exceed your 2010 income tax liability. Calculate and enter the total credit available in Column (a). Enter in Column (b) only

the amount of the credit to be applied against this year’s tax liability. Any difference in the amounts in Columns (a) and (b) for a given

line may be entered at the end of this form and carried forward to the following year.

Column (a)

Column (b)

10 Enterprise zone credits carried over from 2009, attach schedule and original

.00

.00

certification ............................................................................................................... 10

.00

.00

11

Enterprise zone investment credit ........................................................................... 11

.00

.00

12 Enterprise zone new business facility employee credit .......................................... 12

13 Enhanced rural enterprise zone new business facility employee credit ............... 13

.00

.00

.00

.00

14 Enterprise zone agricultural employee processing credit ...................................... 14

15 Enhanced rural enterprise zone agricultural employee processing credit ............ 15

.00

.00

.00

.00

16 Enterprise zone employee health insurance credit ................................................ 16

.00

.00

17 Contribution to enterprise zone administrator credit ............................................... 17

.00

.00

18 Other enterprise zone credits, attach explanation .................................................. 18

19 Total enterprise zone credits, add lines 10 through 18, column (b) ................................................... 19

.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2