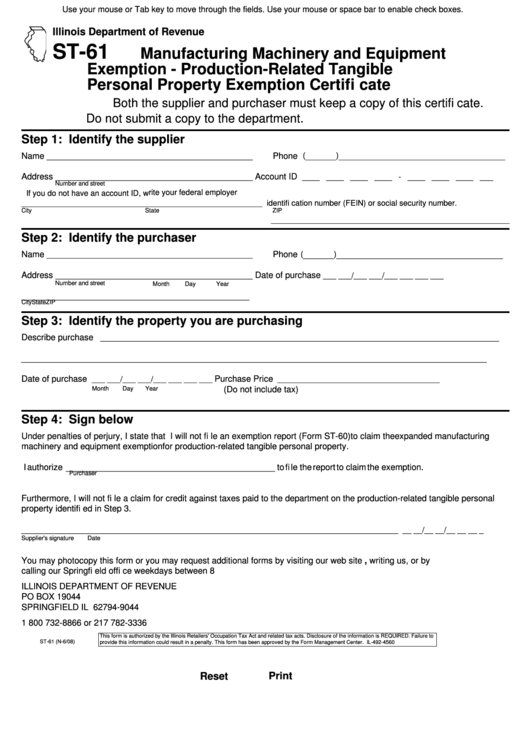

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

ST-61

Manufacturing Machinery and Equipment

Exemption - Production-Related Tangible

Personal Property Exemption Certifi cate

Both the supplier and purchaser must keep a copy of this certifi cate.

Do not submit a copy to the department.

Step 1: Identify the supplier

( _______ ) ______________________________________

Name

Phone

_______________________________________________

Address

Account ID

_____________________________________________

____ ____ ____ ____ - ____ ____ ____ ___

Number and street

If you do not have an account ID, w rite your federal employer

_______________________________________________________

identifi cation number (FEIN) or social security number.

City

State

ZIP

______________________________________________________________________

Step 2: Identify the purchaser

( _______ ) ______________________________________

Name

Phone

_______________________________________________

Address

Date of purchase

_____________________________________________

___ ___/___ ___/___ ___ ___ ___

Number and street

Month

Day

Year

________________________________________________

City

State

ZIP

Step 3: Identify the property you are purchasing

Describe purchase

___________________________________________________________________________________________

__________________________________________________________________________________________________

Date of purchase

Purchase Price

___ ___/___ ___/___ ___ ___ ___

_____________________________________

Month

Day

Year

(Do not include tax)

Step 4: Sign below

Under penalties of perjury, I state that I will not fi le an exemption report (Form ST-60) to claim the expanded manufacturing

machinery and equipment exemption for production-related tangible personal property.

I authorize ____________________________________________ to fi le the report to claim the exemption.

Purchaser

Furthermore, I will not fi le a claim for credit against taxes paid to the department on the production-related tangible personal

property identifi ed in Step 3.

______________________________________________________________________________________

__ __/__ __/__ __ __ _

Supplier's signature

Date

You may photocopy this form or you may request additional forms by visiting our web site tax.illinois.gov, writing us, or by

calling our Springfi eld offi ce weekdays between 8 a.m. and 5 p.m. Our address and telephone number are below.

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19044

SPRINGFIELD IL 62794-9044

1 800 732-8866 or 217 782-3336

This form is authorized by the Illinois Retailers' Occupation Tax Act and related tax acts. Disclosure of the information is REQUIRED. Failure to

ST-61 (N-6/08)

provide this information could result in a penalty. This form has been approved by the Form Management Center. IL-492-4560

Reset

Print

1

1