Instructions For Filing Of Estimated Earned Income Tax

ADVERTISEMENT

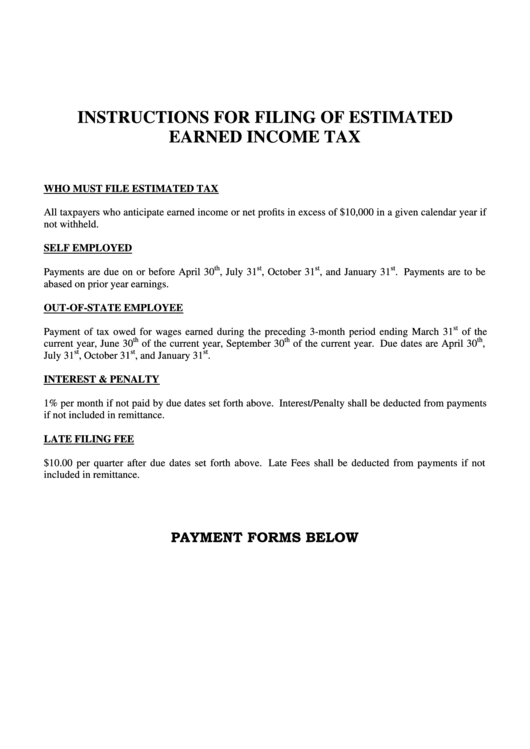

INSTRUCTIONS FOR FILING OF ESTIMATED

EARNED INCOME TAX

WHO MUST FILE ESTIMATED TAX

All taxpayers who anticipate earned income or net profits in excess of $10,000 in a given calendar year if

not withheld.

SELF EMPLOYED

th

st

st

st

Payments are due on or before April 30

, July 31

, October 31

, and January 31

. Payments are to be

abased on prior year earnings.

OUT-OF-STATE EMPLOYEE

st

Payment of tax owed for wages earned during the preceding 3-month period ending March 31

of the

th

th

th

current year, June 30

of the current year, September 30

of the current year. Due dates are April 30

,

st

st

st

July 31

, October 31

, and January 31

.

INTEREST & PENALTY

1% per month if not paid by due dates set forth above. Interest/Penalty shall be deducted from payments

if not included in remittance.

LATE FILING FEE

$10.00 per quarter after due dates set forth above. Late Fees shall be deducted from payments if not

included in remittance.

PAYMENT FORMS BELOW

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2