Form Ft 1120fi - Corporation Franchise Tax Report For Financial Institutions - 2009

ADVERTISEMENT

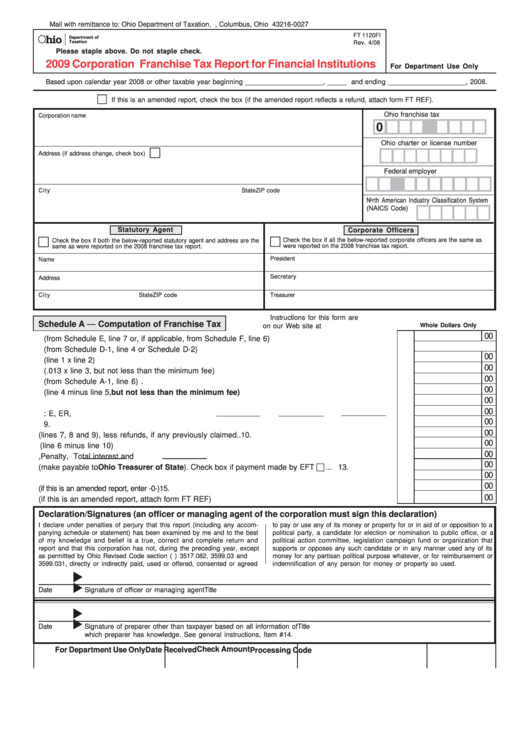

Mail with remittance to: Ohio Department of Taxation, P.O. Box 27, Columbus, Ohio 43216-0027

FT 1120FI

Department of

Taxation

Rev. 4/08

Please staple above. Do not staple check.

2009 Corporation Franchise Tax Report for Financial Institutions

For Department Use Only

Based upon calendar year 2008 or other taxable year beginning ____________________, _____ and ending ____________________, 2008.

—

If this is an amended report, check the box (if the amended report reflects a refund, attach form FT REF).

Ohio franchise tax I.D. number

Corporation name

0

Ohio charter or license number

Address (if address change, check box)

Federal employer I.D. number

City

State

ZIP code

North American Industry Classification System

(NAICS Code)

Statutory Agent

Corporate Officers

Check the box if all the below-reported corporate officers are the same as

Check the box if both the below-reported statutory agent and address are the

same as were reported on the 2008 franchise tax report.

were reported on the 2008 franchise tax report.

President

Name

Secretary

Address

City

State

ZIP code

Treasurer

Instructions for this form are

Schedule A — Computation of Franchise Tax

Whole Dollars Only

on our Web site at tax.ohio.gov.

00

1. Net value of stock (from Schedule E, line 7 or, if applicable, from Schedule F, line 6) .......................

1.

2. Apportionment ratio (from Schedule D-1, line 4 or Schedule D-2) .....................................................

2.

00

3. Taxable value (line 1 x line 2) ...............................................................................................................

3.

00

4. Tax on net worth basis (.013 x line 3, but not less than the minimum fee) .........................................

4.

00

5. Total nonrefundable credits (from Schedule A-1, line 6) .....................................................................

5.

00

6. Tax due after nonrefundable credits (line 4 minus line 5, but not less than the minimum fee) .......

6.

00

7. Overpayment carryforward from 2008 ..................................................................................................

7.

00

8. Estimated payments made in tax year 2009: E

, ER

, EX

...

8.

00

9. Refundable credits ...............................................................................................................................

9.

00

10. Total payments and refundable credits (lines 7, 8 and 9), less refunds, if any previously claimed .. 10.

00

11. Tax due (line 6 minus line 10) .............................................................................................................. 11.

00

12. Interest

, Penalty

, Total interest and penalty .......................................... 12.

00

13. Balance due (make payable to Ohio Treasurer of State). Check box if payment made by EFT ... 13.

00

14. Overpayment ........................................................................................................................................ 14.

00

15. Amount of line 14 to be credited to tax year 2010 estimated tax (if this is an amended report, enter -0-) 15.

00

16. Amount of line 14 to be refunded (if this is an amended report, attach form FT REF) ....................... 16.

Declaration/Signatures (an officer or managing agent of the corporation must sign this declaration)

I declare under penalties of perjury that this report (including any accom-

to pay or use any of its money or property for or in aid of or opposition to a

panying schedule or statement) has been examined by me and to the best

political party, a candidate for election or nomination to public office, or a

of my knowledge and belief is a true, correct and complete return and

political action committee, legislation campaign fund or organization that

report and that this corporation has not, during the preceding year, except

supports or opposes any such candidate or in any manner used any of its

as permitted by Ohio Revised Code section (R.C.) 3517.082, 3599.03 and

money for any partisan political purpose whatever, or for reimbursement or

3599.031, directly or indirectly paid, used or offered, consented or agreed

indemnification of any person for money or property so used.

Date

Signature of officer or managing agent

Title

Date

Signature of preparer other than taxpayer based on all information of

Title

which preparer has knowledge. See general instructions, Item #14.

Check Amount

For Department Use Only

Date Received

Processing Code

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4