Form Ct-611 - Claim For Brownfield Redevelopment Tax Credit - 2006

ADVERTISEMENT

Staple forms here

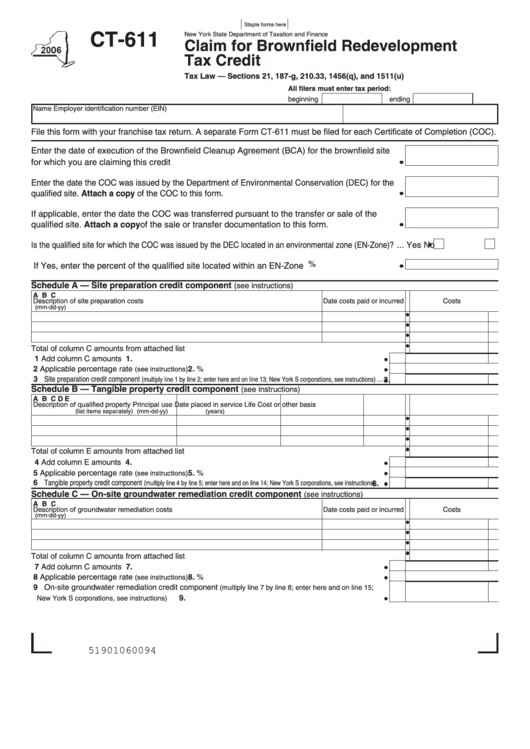

CT-611

New York State Department of Taxation and Finance

Claim for Brownfield Redevelopment

Tax Credit

Tax Law — Sections 21, 187-g, 210.33, 1456(q), and 1511(u)

All filers must enter tax period:

beginning

ending

Name

Employer identification number (EIN)

File this form with your franchise tax return. A separate Form CT-611 must be filed for each Certificate of Completion (COC).

Enter the date of execution of the Brownfield Cleanup Agreement (BCA) for the brownfield site

for which you are claiming this credit ..............................................................................................

Enter the date the COC was issued by the Department of Environmental Conservation (DEC) for the

qualified site. Attach a copy of the COC to this form. ........................................................................

If applicable, enter the date the COC was transferred pursuant to the transfer or sale of the

qualified site. Attach a copy of the sale or transfer documentation to this form. ...........................

Is the qualified site for which the COC was issued by the DEC located in an environmental zone (EN-Zone)? ...

Yes

No

%

If Yes, enter the percent of the qualified site located within an EN-Zone ....................................

Schedule A — Site preparation credit component

(see instructions)

A

B

C

Description of site preparation costs

Date costs paid or incurred

Costs

(mm-dd-yy)

Total of column C amounts from attached list ....................................................................................................

1 Add column C amounts ......................................................................................................................

1.

2 Applicable percentage rate

2.

.......................................................................................

%

(see instructions)

3 Site preparation credit component

...

(multiply line 1 by line 2; enter here and on line 13; New York S corporations, see instructions)

3.

Schedule B — Tangible property credit component

(see instructions)

A

B

C

D

E

Description of qualified property

Principal use

Date placed in service

Life

Cost or other basis

(list items separately)

(mm-dd-yy)

(years)

Total of column E amounts from attached list ....................................................................................................

4 Add column E amounts ......................................................................................................................

4.

5 Applicable percentage rate

5.

.......................................................................................

%

(see instructions)

6 Tangible property credit component

....

(multiply line 4 by line 5; enter here and on line 14; New York S corporations, see instructions)

6.

Schedule C — On-site groundwater remediation credit component

(see instructions)

A

B

C

Description of groundwater remediation costs

Date costs paid or incurred

Costs

(mm-dd-yy)

Total of column C amounts from attached list ....................................................................................................

7 Add column C amounts ......................................................................................................................

7.

8 Applicable percentage rate

8.

.......................................................................................

%

(see instructions)

9 On-site groundwater remediation credit component

(multiply line 7 by line 8; enter here and on line 15;

9.

.............................................................................................

New York S corporations, see instructions)

51901060094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2