Form 651—General Information

(Certificate of Termination of a Domestic Entity)

The attached form is designed to meet minimal statutory filing requirements pursuant to the relevant

code provisions. This form and the information provided are not substitutes for the advice and services of an

attorney and tax specialist.

Commentary

When the owners, members or governing authority of a domestic entity have determined that the

existence of an entity should terminate, or there is an occurrence of an event specified in the governing

documents requiring the winding up, dissolution or termination of a domestic entity, the entity should

follow the procedures for winding up the business and affairs of the entity in the manner provided in

chapter 11 of the Texas Business Organizations Code (BOC). On completion of the winding up process,

a filing entity must file a certificate of termination with the secretary of state. This form is not

applicable to the termination of a nonprofit corporation or a cooperative association.

Instructions for Form

Items 1-4—Entity Information: The certificate of termination must contain the legal name of the

entity. It is recommended that the entity type, date of formation, and file number assigned by the

secretary of state be provided to facilitate processing of the document. Note that this form should

not be used for the termination of a nonprofit corporation or cooperative association.

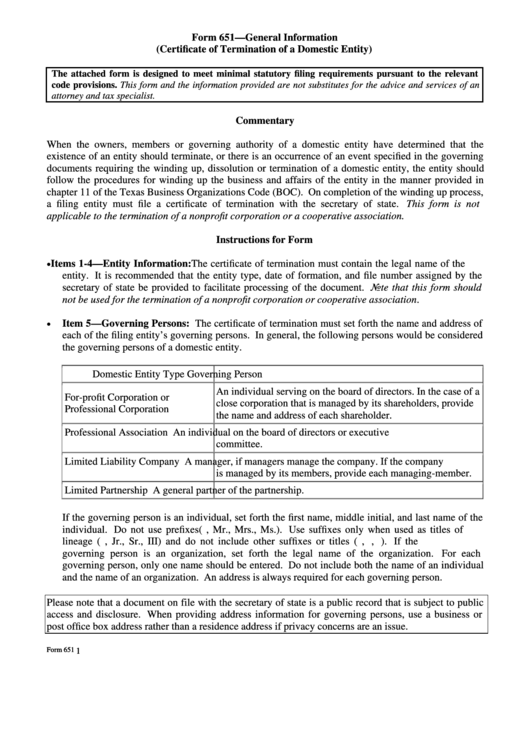

Item 5—Governing Persons: The certificate of termination must set forth the name and address of

each of the filing entity’s governing persons. In general, the following persons would be considered

the governing persons of a domestic entity.

Domestic Entity Type

Governing Person

An individual serving on the board of directors. In the case of a

For-profit Corporation or

close corporation that is managed by its shareholders, provide

Professional Corporation

the name and address of each shareholder.

Professional Association

An individual on the board of directors or executive

committee.

Limited Liability Company

A manager, if managers manage the company. If the company

is managed by its members, provide each managing-member.

Limited Partnership

A general partner of the partnership.

If the governing person is an individual, set forth the first name, middle initial, and last name of the

individual. Do not use prefixes (e.g., Mr., Mrs., Ms.). Use suffixes only when used as titles of

lineage (e.g., Jr., Sr., III) and do not include other suffixes or titles (e.g., M.D., Ph.D.). If the

governing person is an organization, set forth the legal name of the organization.

For each

governing person, only one name should be entered. Do not include both the name of an individual

and the name of an organization. An address is always required for each governing person.

Please note that a document on file with the secretary of state is a public record that is subject to public

access and disclosure. When providing address information for governing persons, use a business or

post office box address rather than a residence address if privacy concerns are an issue.

Form 651

Form 651

1

1

1

1 2

2 3

3 4

4 5

5 6

6