Loveland Business Income Tax Return Form - City Of Loveland, Ohio Income Tax Office - 2003

ADVERTISEMENT

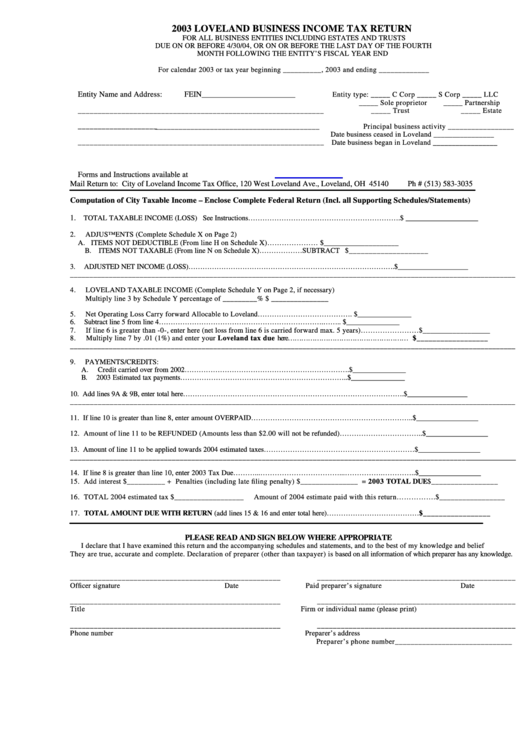

2003 LOVELAND BUSINESS INCOME TAX RETURN

FOR ALL BUSINESS ENTITIES INCLUDING ESTATES AND TRUSTS

DUE ON OR BEFORE 4/30/04, OR ON OR BEFORE THE LAST DAY OF THE FOURTH

MONTH FOLLOWING THE ENTITY’S FISCAL YEAR END

For calendar 2003 or tax year beginning __________, 2003 and ending _____________

Entity Name and Address:

FEIN________________________

Entity type: _____ C Corp _____ S Corp _____ LLC

_____ Sole proprietor

_____ Partnership

______________________________________________________________

_____ Trust

_____ Estate

______________________________________________________________

Principal business activity ______________________

Date business ceased in Loveland ________________

______________________________________________________________

Date business began in Loveland _________________

Forms and Instructions available at

Mail Return to: City of Loveland Income Tax Office, 120 West Loveland Ave., Loveland, OH 45140

Ph # (513) 583-3035

Computation of City Taxable Income – Enclose Complete Federal Return (Incl. all Supporting Schedules/Statements)

1.

TOTAL TAXABLE INCOME (LOSS) See Instructions……………………………………………………….$ ____________________

2.

ADJUSTMENTS (Complete Schedule X on Page 2)

A. ITEMS NOT DEDUCTIBLE (From line H on Schedule X)…………………..ADD $____________________

B.

ITEMS NOT TAXABLE (From line N on Schedule X)………………SUBTRACT $____________________

3.

ADJUSTED NET INCOME (LOSS)…………………………………………………………………………….$____________________

___________________________________________________________________________________________________________________

4.

LOVELAND TAXABLE INCOME (Complete Schedule Y on Page 2, if necessary)

Multiply line 3 by Schedule Y percentage of _________%................................................. $ _______________

5.

Net Operating Loss Carry forward Allocable to Loveland…………………………………. $_______________

6.

Subtract line 5 from line 4…………………………………………………………….…….. $_______________

7.

If line 6 is greater than -0-, enter here (net loss from line 6 is carried forward max. 5 years)……………………$__________________

8.

Multiply line 7 by .01 (1%) and enter your Loveland tax due here……………………………………………… $__________________

___________________________________________________________________________________________________________________

9.

PAYMENTS/CREDITS:

A.

Credit carried over from 2002…………………………………………………………….$_______________

B.

2003 Estimated tax payments……………………………………………………………..$_______________

10. Add lines 9A & 9B, enter total here………………………………………………………………………………….$_________________

___________________________________________________________________________________________________________________

11. If line 10 is greater than line 8, enter amount OVERPAID…………………………………………………………..$_________________

12. Amount of line 11 to be REFUNDED (Amounts less than $2.00 will not be refunded)……………………………..$_________________

13. Amount of line 11 to be applied towards 2004 estimated taxes………………………………………………………$_________________

____________________________________________________________________________________________________________________

14. If line 8 is greater than line 10, enter 2003 Tax Due………...……………………………...…………….…………..$_________________

15. Add interest $__________ + Penalties (including late filing penalty) $_______________ = 2003 TOTAL DUE.......$_________________

16. TOTAL 2004 estimated tax $__________________

Amount of 2004 estimate paid with this return…………….$_________________

17. TOTAL AMOUNT DUE WITH RETURN (add lines 15 & 16 and enter total here)…………………………………$_________________

PLEASE READ AND SIGN BELOW WHERE APPROPRIATE

I declare that I have examined this return and the accompanying schedules and statements, and to the best of my knowledge and belief

They are true, accurate and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

_____________________________________________________

__________________________________________________

Officer signature

Date

Paid preparer’s signature

Date

_____________________________________________________

__________________________________________________

Title

Firm or individual name (please print)

_____________________________________________________

__________________________________________________

Phone number

Preparer’s address

Preparer’s phone number______________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2