Instructions For 2008 Form 4c - Wisconsin Department Of Revenue

ADVERTISEMENT

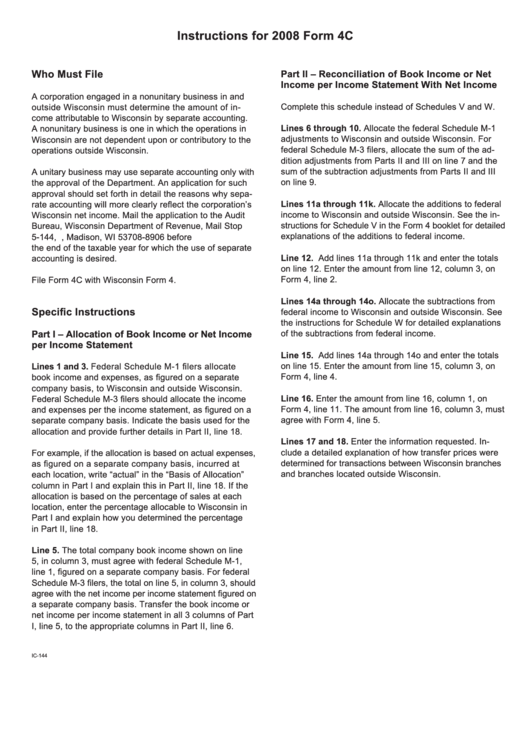

Instructions for 2008 Form 4C

Who Must File

Part II – Reconciliation of Book Income or Net

Income per Income Statement With Net Income

A corporation engaged in a nonunitary business in and

Complete this schedule instead of Schedules V and W.

outside Wisconsin must determine the amount of in-

come attributable to Wisconsin by separate accounting.

Lines 6 through 10. Allocate the federal Schedule M-1

A nonunitary business is one in which the operations in

adjustments to Wisconsin and outside Wisconsin. For

Wisconsin are not dependent upon or contributory to the

federal Schedule M-3 filers, allocate the sum of the ad-

operations outside Wisconsin.

dition adjustments from Parts II and III on line 7 and the

sum of the subtraction adjustments from Parts II and III

A unitary business may use separate accounting only with

on line 9.

the approval of the Department. An application for such

approval should set forth in detail the reasons why sepa-

Lines 11a through 11k. Allocate the additions to federal

rate accounting will more clearly reflect the corporation’s

income to Wisconsin and outside Wisconsin. See the in-

Wisconsin net income. Mail the application to the Audit

structions for Schedule V in the Form 4 booklet for detailed

Bureau, Wisconsin Department of Revenue, Mail Stop

explanations of the additions to federal income.

5-144, P.O. Box 8906, Madison, WI 53708-8906 before

the end of the taxable year for which the use of separate

Line 12. Add lines 11a through 11k and enter the totals

accounting is desired.

on line 12. Enter the amount from line 12, column 3, on

Form 4, line 2.

File Form 4C with Wisconsin Form 4.

Lines 14a through 14o. Allocate the subtractions from

Specific Instructions

federal income to Wisconsin and outside Wisconsin. See

the instructions for Schedule W for detailed explanations

Part I – Allocation of Book Income or Net Income

of the subtractions from federal income.

per Income Statement

Line 15. Add lines 14a through 14o and enter the totals

on line 15. Enter the amount from line 15, column 3, on

Lines 1 and 3. Federal Schedule M-1 filers allocate

Form 4, line 4.

book income and expenses, as figured on a separate

company basis, to Wisconsin and outside Wisconsin.

Line 16. Enter the amount from line 16, column 1, on

Federal Schedule M-3 filers should allocate the income

Form 4, line 11. The amount from line 16, column 3, must

and expenses per the income statement, as figured on a

agree with Form 4, line 5.

separate company basis. Indicate the basis used for the

allocation and provide further details in Part II, line 18.

Lines 17 and 18. Enter the information requested. In-

clude a detailed explanation of how transfer prices were

For example, if the allocation is based on actual expenses,

determined for transactions between Wisconsin branches

as figured on a separate company basis, incurred at

and branches located outside Wisconsin.

each location, write “actual” in the “Basis of Allocation”

column in Part I and explain this in Part II, line 18. If the

allocation is based on the percentage of sales at each

location, enter the percentage allocable to Wisconsin in

Part I and explain how you determined the percentage

in Part II, line 18.

Line 5. The total company book income shown on line

5, in column 3, must agree with federal Schedule M-1,

line 1, figured on a separate company basis. For federal

Schedule M-3 filers, the total on line 5, in column 3, should

agree with the net income per income statement figured on

a separate company basis. Transfer the book income or

net income per income statement in all 3 columns of Part

I, line 5, to the appropriate columns in Part II, line 6.

IC-144

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1