Instructions For Washington Estate Tax Return

ADVERTISEMENT

INSTRUCTIONS

WHO MUST FILE

This Washington Estate Tax Return must be filed by the personal representative if the decedent died on or after May

17, 2005, owned property located in the state of Washington, and the gross estate exceeds the filing threshold for the year of the decedent's

death. A complete copy of the signed Federal Form 706, 706NA, or 706QDT, along with all supporting documentation, must be attached to

the Washington return. There is a different return for deaths occurring prior to May 17, 2005.

FILING THRESHOLDS

Time Period

Filing Threshold

May 17 - December 31, 2005

$1,500,000

January 1, 2006 and thereafter

$2,000,000

WHEN AND WHERE TO FILE

The return is due nine months after the date of death of the decedent. This return is to be filed with the

Department of Revenue, Special Programs Division, PO Box 47488, Olympia, WA 98504-7488.

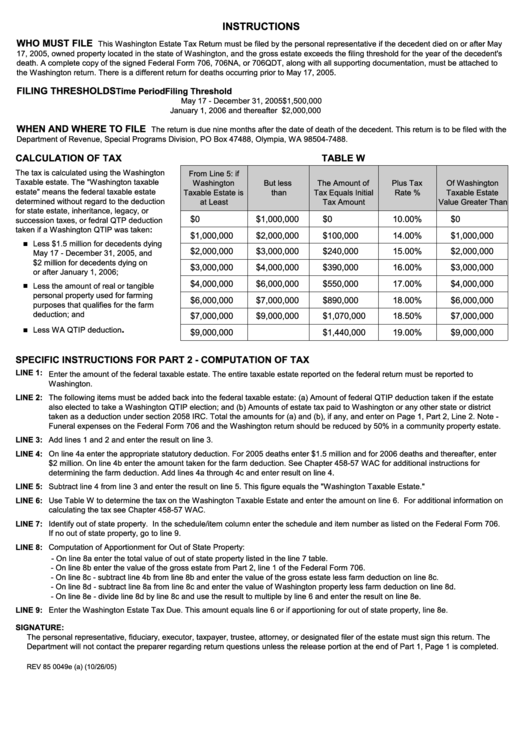

CALCULATION OF TAX

TABLE W

The tax is calculated using the Washington

From Line 5: if

Taxable estate. The "Washington taxable

Washington

But less

The Amount of

Plus Tax

Of Washington

estate" means the federal taxable estate

Taxable Estate is

than

Tax Equals Initial

Rate %

Taxable Estate

determined without regard to the deduction

at Least

Tax Amount

Value Greater Than

for state estate, inheritance, legacy, or

$0

$1,000,000

$0

10.00%

$0

succession taxes, or fedral QTP deduction

taken if a Washington QTIP was taken:

$1,000,000

$2,000,000

$100,000

14.00%

$1,000,000

Less $1.5 million for decedents dying

$2,000,000

$3,000,000

$240,000

15.00%

$2,000,000

May 17 - December 31, 2005, and

$2 million for decedents dying on

$3,000,000

$4,000,000

$390,000

16.00%

$3,000,000

or after January 1, 2006;

$4,000,000

$6,000,000

$550,000

17.00%

$4,000,000

Less the amount of real or tangible

personal property used for farming

$6,000,000

$7,000,000

$890,000

18.00%

$6,000,000

purposes that qualifies for the farm

deduction; and

$7,000,000

$9,000,000

$1,070,000

18.50%

$7,000,000

.

Less WA QTIP deduction

$9,000,000

$1,440,000

19.00%

$9,000,000

SPECIFIC INSTRUCTIONS FOR PART 2 - COMPUTATION OF TAX

LINE 1: Enter the amount of the federal taxable estate. The entire taxable estate reported on the federal return must be reported to

Washington.

LINE 2:

The following items must be added back into the federal taxable estate: (a) Amount of federal QTIP deduction taken if the estate

also elected to take a Washington QTIP election; and (b) Amounts of estate tax paid to Washington or any other state or district

taken as a deduction under section 2058 IRC. Total the amounts for (a) and (b), if any, and enter on Page 1, Part 2, Line 2. Note -

Funeral expenses on the Federal Form 706 and the Washington return should be reduced by 50% in a community property estate.

LINE 3:

Add lines 1 and 2 and enter the result on line 3.

LINE 4:

On line 4a enter the appropriate statutory deduction. For 2005 deaths enter $1.5 million and for 2006 deaths and thereafter, enter

$2 million. On line 4b enter the amount taken for the farm deduction. See Chapter 458-57 WAC for additional instructions for

determining the farm deduction. Add lines 4a through 4c and enter result on line 4.

LINE 5:

Subtract line 4 from line 3 and enter the result on line 5. This figure equals the "Washington Taxable Estate."

LINE 6:

Use Table W to determine the tax on the Washington Taxable Estate and enter the amount on line 6. For additional information on

calculating the tax see Chapter 458-57 WAC.

LINE 7:

Identify out of state property. In the schedule/item column enter the schedule and item number as listed on the Federal Form 706.

If no out of state property, go to line 9.

LINE 8:

Computation of Apportionment for Out of State Property:

- On line 8a enter the total value of out of state property listed in the line 7 table.

- On line 8b enter the value of the gross estate from Part 2, line 1 of the Federal Form 706.

- On line 8c - subtract line 4b from line 8b and enter the value of the gross estate less farm deduction on line 8c.

- On line 8d - subtract line 8a from line 8c and enter the value of Washington property less farm deduction on line 8d.

- On line 8e - divide line 8d by line 8c and use the result to multiple by line 6 and enter the result on line 8e.

LINE 9:

Enter the Washington Estate Tax Due. This amount equals line 6 or if apportioning for out of state property, line 8e.

SIGNATURE:

The personal representative, fiduciary, executor, taxpayer, trustee, attorney, or designated filer of the estate must sign this return. The

Department will not contact the preparer regarding return questions unless the release portion at the end of Part 1, Page 1 is completed.

REV 85 0049e (a) (10/26/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2