Rollover Contribution Form

ADVERTISEMENT

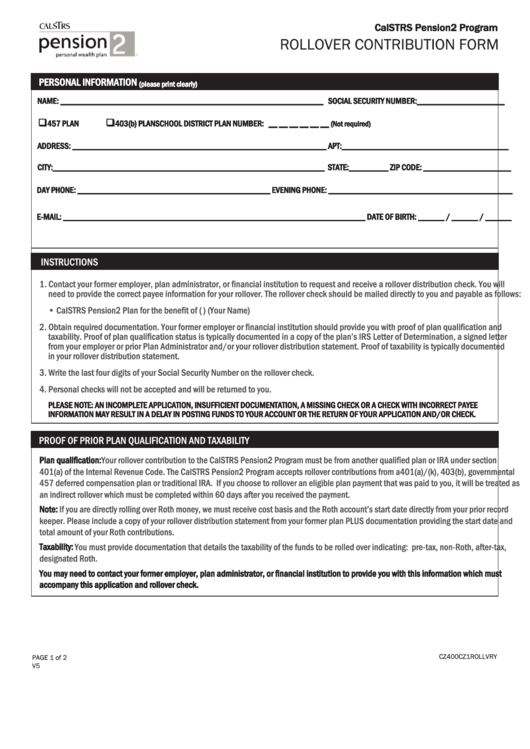

CalSTRS Pension2 Program

ROLLOVER CONTRIBUTION FORM

PERSONAL INFORMATION

(please print clearly)

NAME: ____________________________________________________________ SOCIAL SECURITY NUMBER: ____________________

457 PLAN

403(b) PLAN

SCHOOL DISTRICT PLAN NUMBER: __ __ __ __ __ __

(Not required)

ADDRESS: __________________________________________________________ APT:______________________________________

CITY:______________________________________________________________ STATE:_________ ZIP CODE: __________________ __

DAY PHONE: ____________________________________________ EVENING PHONE: __________________________________________

E-MAIL: _____________________________________________________________________ DATE OF BIRTH: ______ / ______ / ______

INSTRUCTIONS

1. Contact your former employer, plan administrator, or financial institution to request and receive a rollover distribution check. You will

need to provide the correct payee information for your rollover. The rollover check should be mailed directly to you and payable as follows:

• CalSTRS Pension2 Plan for the benefit of (F.B.O.) (Your Name)

2. Obtain required documentation. Your former employer or financial institution should provide you with proof of plan qualification and

taxability. Proof of plan qualification status is typically documented in a copy of the plan’s IRS Letter of Determination, a signed letter

from your employer or prior Plan Administrator and/or your rollover distribution statement. Proof of taxability is typically documented

in your rollover distribution statement.

3. Write the last four digits of your Social Security Number on the rollover check.

4. Personal checks will not be accepted and will be returned to you.

PLEASE NOTE: AN INCOMPLETE APPLICATION, INSUFFICIENT DOCUMENTATION, A MISSING CHECK OR A CHECK WITH INCORRECT PAYEE

INFORMATION MAY RESULT IN A DELAY IN POSTING FUNDS TO YOUR ACCOUNT OR THE RETURN OF YOUR APPLICATION AND/OR CHECK.

PROOF OF PRIOR PLAN QUALIFICATION AND TAXABILITY

Plan qualification:

Your rollover contribution to the CalSTRS Pension2 Program must be from another qualified plan or IRA under section

401(a) of the Internal Revenue Code. The CalSTRS Pension2 Program accepts rollover contributions from a401(a)/(k), 403(b), governmental

457 deferred compensation plan or traditional IRA. If you choose to rollover an eligible plan payment that was paid to you, it will be treated as

an indirect rollover which must be completed within 60 days after you received the payment.

Note:

If you are directly rolling over Roth money, we must receive cost basis and the Roth account’s start date directly from your prior record

keeper. Please include a copy of your rollover distribution statement from your former plan PLUS documentation providing the start date and

total amount of your Roth contributions.

Taxability:

You must provide documentation that details the taxability of the funds to be rolled over indicating: pre-tax, non-Roth, after-tax,

designated Roth.

You may need to contact your former employer, plan administrator, or financial institution to provide you with this information which must

accompany this application and rollover check.

CZ400CZ1ROLLVRY

PAGE 1 of 2

V5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2