Instructions For Form St-16 - Kansas Retailers' Sales Tax Return - 2005 Page 7

ADVERTISEMENT

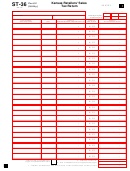

5

8.525/9.525%

0.1050

7.8/9.8%*

0.2041

8.55/9.55%

0.1047

7.85/8.85%

0.1130

8.55/9.925%*

0.1385

7.9/8.9%

0.1124

7.9/9.9%*

0.2020

8.55/10.55%*

0.1900

7.925/8.925%

0.1120

8.65/9.65%

0.1036

8.775/9.775%

0.1023

7.95/8.95%

0.1117

8.8/9.8%

0.1020

8.025/9.025%

0.1108

8.85/9.85%

0.1015

8.05/9.05%

0.1105

8.15/9.15%

0.1093

8.9/9.9%

0.1010

8.15/9.525%*

0.1444

8.925/9.925%

0.1008

9.05/10.05%

0.0995

8.275/9.275%

0.1078

9.3/10.3% 0.0971

8.3/9.3%

0.1075

9.55/10.55%

0.0948

IX. How the Factor is Determined. Each Factor is calculated by applying the following

formula to the two tax rates: (New Rate minus Old Rate = X); (X divided by New Rate =

Factor). The formula may be used to determine a Factor for a rate change not listed in the

Factor Table. An asterisk (*) indicates that both the state rate and a local sales tax rate

were increased on July 1, 2010, since the difference between the two rates is more than

the 1% state rate increase.

There are multiple Factors because sales tax returns capture a retailer's sales receipts

based on each jurisdiction where a sale is sourced. Each jurisdiction is assigned a Taxing

Jurisdiction Code that references its combined sales tax rate, which is the state rate plus

all applicable city and county rates. Pub. KS-1700. Because local sales tax rates vary,

there is no single Factor that can be used for all receipts.

To find the local sales and use tax rate increases, go to the department's website,

, and click on: Your Business

Sales Tax

Latest Local Rate

Changes

Effective July 1, 2010 - Sales Tax Rate Updates Only.

X. Examples. Examples will be published on the department's website by July 1, 2010

showing how different electronically filed Kansas sales tax returns should be completed

when a return includes some sales invoiced at the 5.3% state rate, and others sales

invoiced at the 6.3% state rate.

Taxpayer Assistance. Additional copies of this Notice, and other department forms or

publications, may be download from our website, . If you have

questions about this rate increase and how it applies, please contact:

Taxpayer Assistance Center

Phone: 785-368-8222

Kansas Department of Revenue

Hearing Impaired TTY: 785-296-6461

915 SW Harrison St., 1st Floor

Fax: 785-291-3614

Topeka, KS 66612-1588

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7