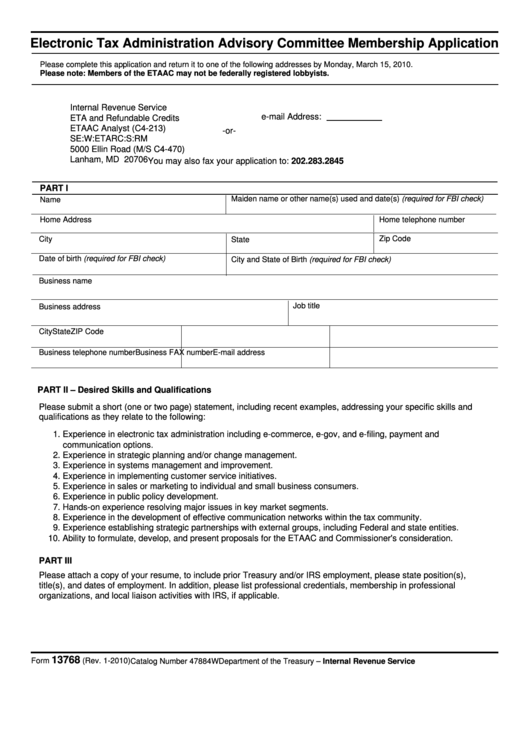

Electronic Tax Administration Advisory Committee Membership Application

Please complete this application and return it to one of the following addresses by Monday, March 15, 2010.

Please note: Members of the ETAAC may not be federally registered lobbyists.

Internal Revenue Service

e-mail Address: etaac@irs.gov

ETA and Refundable Credits

ETAAC Analyst (C4-213)

-or-

SE:W:ETARC:S:RM

5000 Ellin Road (M/S C4-470)

Lanham, MD 20706

You may also fax your application to: 202.283.2845

PART I

Maiden name or other name(s) used and date(s) (required for FBI check)

Name

Home Address

Home telephone number

Zip Code

City

State

Date of birth (required for FBI check)

City and State of Birth (required for FBI check)

Business name

Job title

Business address

City

State

ZIP Code

Business telephone number

Business FAX number

E-mail address

PART II – Desired Skills and Qualifications

Please submit a short (one or two page) statement, including recent examples, addressing your specific skills and

qualifications as they relate to the following:

1. Experience in electronic tax administration including e-commerce, e-gov, and e-filing, payment and

communication options.

2. Experience in strategic planning and/or change management.

3. Experience in systems management and improvement.

4. Experience in implementing customer service initiatives.

5. Experience in sales or marketing to individual and small business consumers.

6. Experience in public policy development.

7. Hands-on experience resolving major issues in key market segments.

8. Experience in the development of effective communication networks within the tax community.

9. Experience establishing strategic partnerships with external groups, including Federal and state entities.

10. Ability to formulate, develop, and present proposals for the ETAAC and Commissioner's consideration.

PART III

Please attach a copy of your resume, to include prior Treasury and/or IRS employment, please state position(s),

title(s), and dates of employment. In addition, please list professional credentials, membership in professional

organizations, and local liaison activities with IRS, if applicable.

13768

Form

(Rev. 1-2010)

Catalog Number 47884W

Department of the Treasury – Internal Revenue Service

1

1 2

2