Montana Individual Income Tax Forms And Instructions - 2006

ADVERTISEMENT

2006 Montana Individual Income Tax Instructions

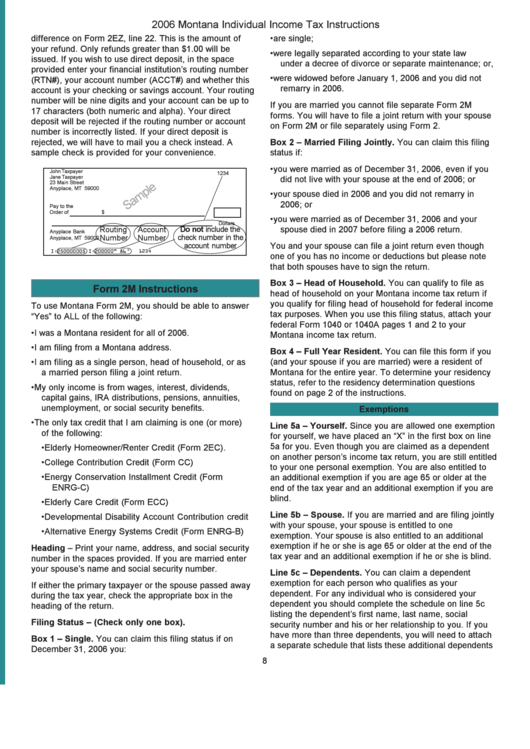

difference on Form 2EZ, line 22. This is the amount of

• are single;

your refund. Only refunds greater than $1.00 will be

• were legally separated according to your state law

issued. If you wish to use direct deposit, in the space

under a decree of divorce or separate maintenance; or,

provided enter your financial institution’s routing number

• were widowed before January 1, 2006 and you did not

(RTN#), your account number (ACCT#) and whether this

remarry in 2006.

account is your checking or savings account. Your routing

number will be nine digits and your account can be up to

If you are married you cannot file separate Form 2M

17 characters (both numeric and alpha). Your direct

forms. You will have to file a joint return with your spouse

deposit will be rejected if the routing number or account

on Form 2M or file separately using Form 2.

number is incorrectly listed. If your direct deposit is

rejected, we will have to mail you a check instead. A

Box 2 – Married Filing Jointly. You can claim this filing

sample check is provided for your convenience.

status if:

• you were married as of December 31, 2006, even if you

John Taxpayer

1234

Jane Taxpayer

did not live with your spouse at the end of 2006; or

23 Main Street

Anyplace, MT 59000

• your spouse died in 2006 and you did not remarry in

2006; or

Pay to the

Order of

$

• you were married as of December 31, 2006 and your

Dollars

Routing

Do not include the

spouse died in 2007 before filing a 2006 return.

Account

Anyplace Bank

Number

Number

check number in the

Anyplace, MT 59000

You and your spouse can file a joint return even though

account number

I:250000005 I:200000" 86 "

1234

one of you has no income or deductions but please note

that both spouses have to sign the return.

Box 3 – Head of Household. You can qualify to file as

Form 2M Instructions

head of household on your Montana income tax return if

you qualify for filing head of household for federal income

To use Montana Form 2M, you should be able to answer

tax purposes. When you use this filing status, attach your

“Yes” to ALL of the following:

federal Form 1040 or 1040A pages 1 and 2 to your

• I was a Montana resident for all of 2006.

Montana income tax return.

• I am filing from a Montana address.

Box 4 – Full Year Resident. You can file this form if you

(and your spouse if you are married) were a resident of

• I am filing as a single person, head of household, or as

Montana for the entire year. To determine your residency

a married person filing a joint return.

status, refer to the residency determination questions

• My only income is from wages, interest, dividends,

found on page 2 of the instructions.

capital gains, IRA distributions, pensions, annuities,

unemployment, or social security benefits.

Exemptions

• The only tax credit that I am claiming is one (or more)

Line 5a – Yourself. Since you are allowed one exemption

of the following:

for yourself, we have placed an “X” in the first box on line

5a for you. Even though you are claimed as a dependent

• Elderly Homeowner/Renter Credit (Form 2EC).

on another person’s income tax return, you are still entitled

• College Contribution Credit (Form CC)

to your one personal exemption. You are also entitled to

• Energy Conservation Installment Credit (Form

an additional exemption if you are age 65 or older at the

ENRG-C)

end of the tax year and an additional exemption if you are

blind.

• Elderly Care Credit (Form ECC)

Line 5b – Spouse. If you are married and are filing jointly

• Developmental Disability Account Contribution credit

with your spouse, your spouse is entitled to one

• Alternative Energy Systems Credit (Form ENRG-B)

exemption. Your spouse is also entitled to an additional

exemption if he or she is age 65 or older at the end of the

Heading – Print your name, address, and social security

tax year and an additional exemption if he or she is blind.

number in the spaces provided. If you are married enter

your spouse’s name and social security number.

Line 5c – Dependents. You can claim a dependent

exemption for each person who qualifies as your

If either the primary taxpayer or the spouse passed away

dependent. For any individual who is considered your

during the tax year, check the appropriate box in the

dependent you should complete the schedule on line 5c

heading of the return.

listing the dependent’s first name, last name, social

Filing Status – (Check only one box).

security number and his or her relationship to you. If you

have more than three dependents, you will need to attach

Box 1 – Single. You can claim this filing status if on

a separate schedule that lists these additional dependents

December 31, 2006 you:

8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11