Form 403(B) - Salary Reduction Agreement

ADVERTISEMENT

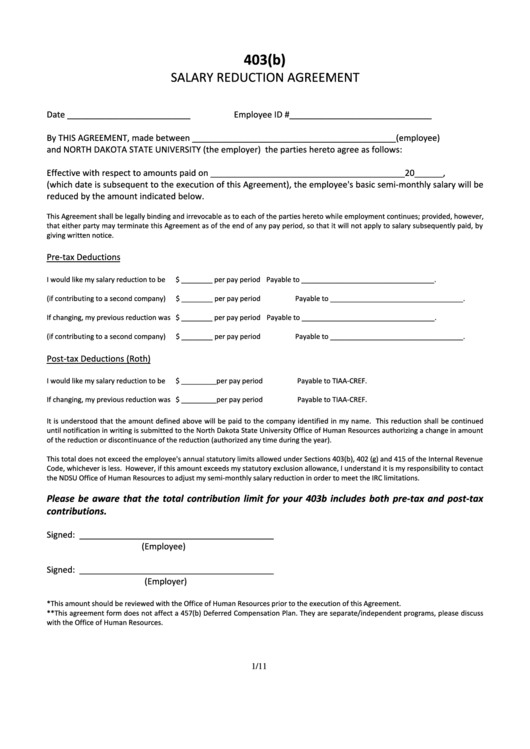

403(b)

SALARY REDUCTION AGREEMENT

Date __________________________

Employee ID #______________________________

By THIS AGREEMENT, made between ___________________________________________(employee)

and NORTH DAKOTA STATE UNIVERSITY (the employer) the parties hereto agree as follows:

Effective with respect to amounts paid on _________________________________________20______,

(which date is subsequent to the execution of this Agreement), the employee's basic semi‐monthly salary will be

reduced by the amount indicated below.

This Agreement shall be legally binding and irrevocable as to each of the parties hereto while employment continues; provided, however,

that either party may terminate this Agreement as of the end of any pay period, so that it will not apply to salary subsequently paid, by

giving written notice.

Pre‐tax Deductions

I would like my salary reduction to be $ ________ per pay period

Payable to __________________________________.

(if contributing to a second company) $ ________ per pay period

Payable to __________________________________.

If changing, my previous reduction was $ ________ per pay period

Payable to __________________________________.

(if contributing to a second company) $ ________ per pay period

Payable to __________________________________.

Post‐tax Deductions (Roth)

I would like my salary reduction to be $ _________per pay period

Payable to TIAA‐CREF.

If changing, my previous reduction was $ _________per pay period

Payable to TIAA‐CREF.

It is understood that the amount defined above will be paid to the company identified in my name. This reduction shall be continued

until notification in writing is submitted to the North Dakota State University Office of Human Resources authorizing a change in amount

of the reduction or discontinuance of the reduction (authorized any time during the year).

This total does not exceed the employee's annual statutory limits allowed under Sections 403(b), 402 (g) and 415 of the Internal Revenue

Code, whichever is less. However, if this amount exceeds my statutory exclusion allowance, I understand it is my responsibility to contact

the NDSU Office of Human Resources to adjust my semi‐monthly salary reduction in order to meet the IRC limitations.

Please be aware that the total contribution limit for your 403b includes both pre‐tax and post‐tax

contributions.

Signed: _________________________________________

(Employee)

Signed: _________________________________________

(Employer)

*This amount should be reviewed with the Office of Human Resources prior to the execution of this Agreement.

**This agreement form does not affect a 457(b) Deferred Compensation Plan. They are separate/independent programs, please discuss

with the Office of Human Resources.

1/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1