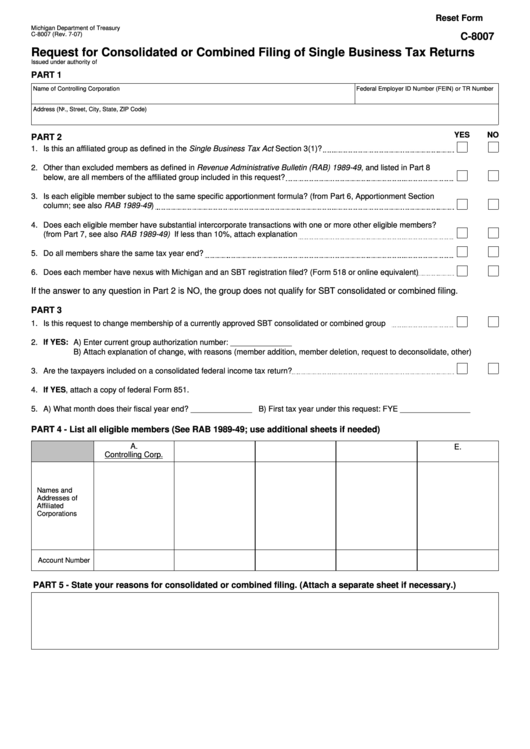

Reset Form

Michigan Department of Treasury

C-8007 (Rev. 7-07)

C-8007

Request for Consolidated or Combined Filing of Single Business Tax Returns

Issued under authority of P.A. 228 of 1975.

PART 1

Name of Controlling Corporation

Federal Employer ID Number (FEIN) or TR Number

Address (No., Street, City, State, ZIP Code)

YES

NO

PART 2

1.

Is this an affiliated group as defined in the Single Business Tax Act Section 3(1)?

2.

Other than excluded members as defined in Revenue Administrative Bulletin (RAB) 1989-49, and listed in Part 8

below, are all members of the affiliated group included in this request?

3.

Is each eligible member subject to the same specific apportionment formula? (from Part 6, Apportionment Section

column; see also RAB 1989-49)

4.

Does each eligible member have substantial intercorporate transactions with one or more other eligible members?

(from Part 7, see also RAB 1989-49) If less than 10%, attach explanation

5.

Do all members share the same tax year end?

6.

Does each member have nexus with Michigan and an SBT registration filed? (Form 518 or online equivalent)

If the answer to any question in Part 2 is NO, the group does not qualify for SBT consolidated or combined filing.

PART 3

1.

Is this request to change membership of a currently approved SBT consolidated or combined group

2.

If YES:

A) Enter current group authorization number: ______________

B) Attach explanation of change, with reasons (member addition, member deletion, request to deconsolidate, other)

3.

Are the taxpayers included on a consolidated federal income tax return?

4.

If YES, attach a copy of federal Form 851.

5.

A) What month does their fiscal year end? ______________ B) First tax year under this request: FYE ________________

PART 4 - List all eligible members (See RAB 1989-49; use additional sheets if needed)

A.

B.

C.

D.

E.

Controlling Corp.

Names and

Addresses of

Affiliated

Corporations

Account Number

PART 5 - State your reasons for consolidated or combined filing. (Attach a separate sheet if necessary.)

1

1 2

2 3

3