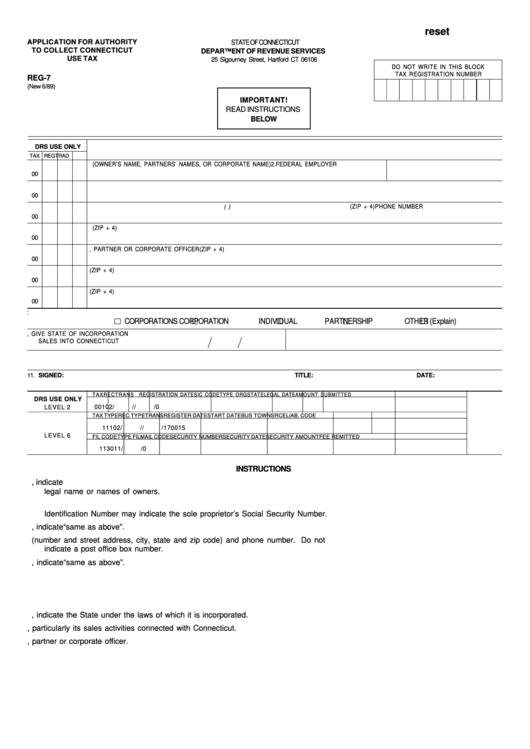

reset

APPLICATION FOR AUTHORITY

STATE OF CONNECTICUT

TO COLLECT CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

USE TAX

25 Sigourney Street, Hartford CT 06106

DO NOT WRITE IN THIS BLOCK

TAX REGISTRATION NUMBER

REG-7

(New 6/89)

IMPORTANT!

READ INSTRUCTIONS

BELOW

DRS USE ONLY

TAX REG

TR

AD

1 . LEGAL NAME OF BUSINESS (OWNER’S NAME, PARTNERS’ NAMES, OR CORPORATE NAME)

2. FEDERAL EMPLOYER I.D. NUMBER

00

3 . TRADE OR REGISTERED NAME OF BUSINESS IF DIFFERENT FROM ITEM 1 ABOVE

00

4 . PHYSICAL LOCATION OF THIS BUSINESS

(P.O. Box is not acceptable)

(ZIP + 4)

PHONE NUMBER

00

5 . BUSINESS MAIL ADDRESS IF DIFFERENT FROM ITEM 4 ABOVE

(ZIP + 4)

00

6a. NAME AND HOME ADDRESS OF OWNER, PARTNER OR CORPORATE OFFICER

(ZIP + 4)

00

6b. NAME AND HOME ADDRESS OF PARTNER OR OFFICER

(ZIP + 4)

00

6c. NAME AND HOME ADDRESS OF PARTNER OR OFFICER

(ZIP + 4)

00

7 . TYPE OF ORGANIZATION:

CORPORATION

S CORPORATION

INDIVIDUAL

PARTNERSHIP

OTHER (Explain)

8 . DATE THIS BUSINESS STARTED MAKING

M

D

Y

9 . IF A CORPORATION, GIVE STATE OF INCORPORATION

SALES INTO CONNECTICUT

10. DESCRIBE IN DETAIL THE TYPE OF BUSINESS YOU OPERATE

11. SIGNED:

TITLE:

DATE:

TAX

R E C

T R A N S

REGISTRATION DATE

SIC CODE

TYPE ORG STATE

LEGAL DATE

AMOUNT SUBMITTED

DRS USE ONLY

00

10

2

/

/

/

/

0

LEVEL 2

TAX TYPE

REC TYPE

TRANS

REGISTER DATE

START DATE

BUS TOWN

SRCE

LIAB. CODE

11

10

2

/

/

/

/

170

01

5

LEVEL 6

FIL CODE

TYPE FIL

MAIL CODE

SECURITY NUMBER

SECURITY DATE

SECURITY AMOUNT

FEE REMITTED

1130

1

1

/

/

0

INSTRUCTIONS

1. Indicate the exact legal name of business for which this application is being completed. If sole proprietorship or partnership, indicate

legal name or names of owners.

2. Indicate the Federal Employer Identification Number assigned to this business. Sole proprietors not assigned a Federal Employer

Identification Number may indicate the sole proprietor’s Social Security Number.

3. Indicate the trade name of this business if different from Item 1. If not different, indicate “same as above”.

4. Indicate the physical location of this business (number and street address, city, state and zip code) and phone number. Do not

indicate a post office box number.

5. Indicate a business mailing address if different from Item 5. If not different, indicate “same as above”.

6. Indicate the name and home address of the owner or each partner or each corporate officer. Attach a list if more space is needed.

7. Check the appropriate box.

8. Indicate the date on which this business started to make sales into Connecticut.

9. If this business is incorporated, indicate the State under the laws of which it is incorporated.

10. Describe fully the activities of this business, particularly its sales activities connected with Connecticut.

11. This application must be signed by an owner, partner or corporate officer.

1

1