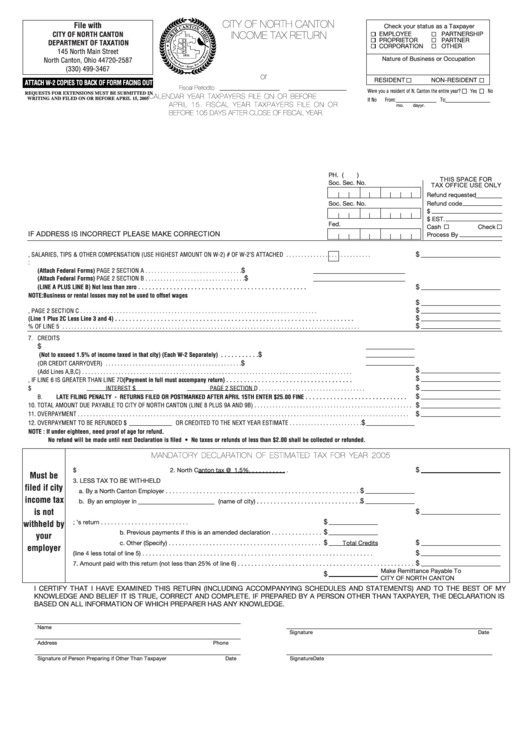

City Of North Canton Income Tax Return Form

ADVERTISEMENT

CITY OF NORTH CANTON

File with

Check your status as a Taxpayer

INCOME TAX RETURN

CITY OF NORTH CANTON

EMPLOYEE

PARTNERSHIP

PROPRIETOR

PARTNER

DEPARTMENT OF TAXATION

CORPORATION

OTHER

145 North Main Street

Nature of Business or Occupation

North Canton, Ohio 44720-2587

(330) 499-3467

or

RESIDENT

NON-RESIDENT

ATTACH W-2 COPIES TO BACK OF FORM FACING OUT

Fiscal Period

to

Were you a resident of N. Canton the entire year?

Yes

No

REQUESTS FOR EXTENSIONS MUST BE SUBMITTED IN

CALENDAR YEAR TAXPAYERS FILE ON OR BEFORE

WRITING AND FILED ON OR BEFORE APRIL 15, 2005

If No

From:

To:

APRIL 15. FISCAL YEAR TAXPAYERS FILE ON OR

mo.

day

yr.

mo.

day

yr.

BEFORE 105 DAYS AFTER CLOSE OF FISCAL YEAR.

PH. (

)

THIS SPACE FOR

Soc. Sec. No.

TAX OFFICE USE ONLY

Refund requested

Soc. Sec. No.

Refund code

$

$ EST.

Fed. I.D. No.

Cash

Check

IF ADDRESS IS INCORRECT PLEASE MAKE CORRECTION

Process By

$

1. GROSS WAGES, SALARIES, TIPS & OTHER COMPENSATION (USE HIGHEST AMOUNT ON W-2) # OF W-2’S ATTACHED . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. OTHER TAXABLE INCOME:

$

A.

BUSINESS PROFIT (Attach Federal Forms) PAGE 2 SECTION A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

B.

RENTAL INCOME (Attach Federal Forms) PAGE 2 SECTION B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

C.

TOTAL OTHER TAXABLE INCOME (LINE A PLUS LINE B) Not less than zero . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

NOTE:

Business or rental losses may not be used to offset wages

$

3. DEDUCT NON TAXABLE INCOME . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

4. FEDERAL FORM 2106 DEDUCTION, PAGE 2 SECTION C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

5. TAXABLE INCOME (Line 1 Plus 2C Less Line 3 and 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

6. CITY TAX DUE 1.5% OF LINE 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. CREDITS

$

A.

NORTH CANTON INCOME TAX WITHHELD . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

B.

INCOME TAX PAID OTHER CITIES (Not to exceed 1.5% of income taxed in that city) (Each W-2 Separately) . . . . . . . . . . .

$

C.

PAYMENTS ON CURRENT DECLARATION (OR CREDIT CARRYOVER) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

D.

TOTAL CREDITS (Add Lines A,B,C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

8. BALANCE TAX DUE, IF LINE 6 IS GREATER THAN LINE 7D (Payment in full must accompany return) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

9. A.

PENALTY $

INTEREST $

PAGE 2 SECTION D . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

B.

LATE FILING PENALTY - RETURNS FILED OR POSTMARKED AFTER APRIL 15TH ENTER $25.00 FINE . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

10. TOTAL AMOUNT DUE PAYABLE TO CITY OF NORTH CANTON (LINE 8 PLUS 9A AND 9B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

11. OVERPAYMENT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

12. OVERPAYMENT TO BE REFUNDED $

OR CREDITED TO THE NEXT YEAR ESTIMATE . . . . . . . . . . . . . . . . . . . . . . . .

NOTE : If under eighteen, need proof of age for refund.

No refund will be made until next Declaration is filed • No taxes or refunds of less than $2.00 shall be collected or refunded.

MANDATORY DECLARATION OF ESTIMATED TAX FOR YEAR 2005

$

1. Total income subject to North Canton tax $

2. North Canton tax @ 1.5% . . . . . . . . . . . .

Must be

3. LESS TAX TO BE WITHHELD

filed if city

$

a. By a North Canton Employer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

income tax

$

b. By an employer in

(name of city) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

is not

$

4. Balance estimated North Canton tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

5. Less Credits; a. Overpayment on previous year’s return . . . . . . . . . . . . . . . . . . . . . . . . . .

withheld by

$

b. Previous payments if this is an amended declaration . . . . . . . . . . . . . . .

your

$

$

c. Other (Specify) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total Credits

employer

$

6. Net Tax due (line 4 less total of line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

7. Amount paid with this return (not less than 25% of line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Make Remittance Payable To

$

8. Balance of Tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

CITY OF NORTH CANTON

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY

KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THE DECLARATION IS

BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

Name

Signature

Date

Address

Phone

Signature of Person Preparing if Other Than Taxpayer

Date

Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2