Super Research And Development Tax Credit Worksheet - 2010

ADVERTISEMENT

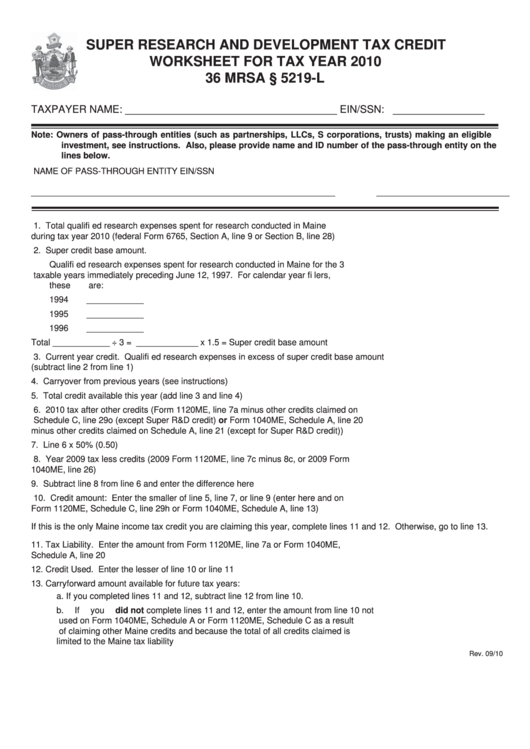

SUPER RESEARCH AND DEVELOPMENT TAX CREDIT

WORKSHEET FOR TAX YEAR 2010

36 MRSA § 5219-L

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (such as partnerships, LLCs, S corporations, trusts) making an eligible

investment, see instructions. Also, please provide name and ID number of the pass-through entity on the

lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

1. Total qualifi ed research expenses spent for research conducted in Maine

during tax year 2010 (federal Form 6765, Section A, line 9 or Section B, line 28) ................. 1. __________________

2. Super credit base amount.

Qualifi ed research expenses spent for research conducted in Maine for the 3

taxable years immediately preceding June 12, 1997. For calendar year fi lers,

these are:

1994 ____________

1995 ____________

1996 ____________

Total ____________ ÷ 3 = _____________ x 1.5 = Super credit base amount ................... 2. __________________

3. Current year credit. Qualifi ed research expenses in excess of super credit base amount

(subtract line 2 from line 1) ..................................................................................................... 3. __________________

4. Carryover from previous years (see instructions) ................................................................... 4. __________________

5. Total credit available this year (add line 3 and line 4) ............................................................. 5. __________________

6. 2010 tax after other credits (Form 1120ME, line 7a minus other credits claimed on

Schedule C, line 29o (except Super R&D credit) or Form 1040ME, Schedule A, line 20

minus other credits claimed on Schedule A, line 21 (except for Super R&D credit)) .............. 6. __________________

7. Line 6 x 50% (0.50) ................................................................................................................. 7. __________________

8. Year 2009 tax less credits (2009 Form 1120ME, line 7c minus 8c, or 2009 Form

1040ME, line 26) ..................................................................................................................... 8. __________________

9. Subtract line 8 from line 6 and enter the difference here ........................................................ 9. __________________

10. Credit amount: Enter the smaller of line 5, line 7, or line 9 (enter here and on

Form 1120ME, Schedule C, line 29h or Form 1040ME, Schedule A, line 13) ...................... 10. __________________

If this is the only Maine income tax credit you are claiming this year, complete lines 11 and 12. Otherwise, go to line 13.

11. Tax Liability. Enter the amount from Form 1120ME, line 7a or Form 1040ME,

Schedule A, line 20 ............................................................................................................... 11. __________________

12. Credit Used. Enter the lesser of line 10 or line 11 ................................................................ 12. __________________

13. Carryforward amount available for future tax years:

a.

If you completed lines 11 and 12, subtract line 12 from line 10.

b.

If you did not complete lines 11 and 12, enter the amount from line 10 not

used on Form 1040ME, Schedule A or Form 1120ME, Schedule C as a result

of claiming other Maine credits and because the total of all credits claimed is

limited to the Maine tax liability ................................................................................... 13. __________________

Rev. 09/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1