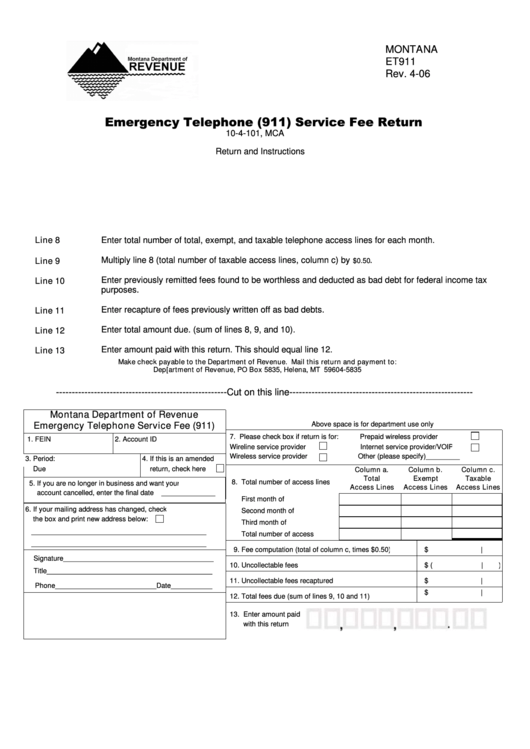

Form Et911 - Emergency Telephone (911) Service Fee Return April 2006

ADVERTISEMENT

MONTANA

ET911

Rev. 4-06

Emergency Telephone (911) Service Fee Return

10-4-101, MCA

Return and Instructions

Line 8

Enter total number of total, exempt, and taxable telephone access lines for each month.

Multiply line 8 (total number of taxable access lines, column c) by

.

Line 9

$0.50

Enter previously remitted fees found to be worthless and deducted as bad debt for federal income tax

Line 10

purposes.

Enter recapture of fees previously written off as bad debts.

Line 11

Enter total amount due. (sum of lines 8, 9, and 10).

Line 12

Enter amount paid with this return. This should equal line 12.

Line 13

Make check payable to the Department of Revenue. Mail this return and payment to:

Dep[artment of Revenue, PO Box 5835, Helena, MT 59604-5835

------------------------------------------------------Cut on this line----------------------------------------------------------

Montana Department of Revenue

Above space is for department use only

Emergency Telephone Service Fee (911)

7. Please check box if return is for:

Prepaid wireless provider

1. FEIN

2. Account ID

Wireline service provider

Internet service provider/VOIP

Wireless service provider

Other (please specify)_________

3. Period:

4. If this is an amended

Due

return, check here

Column a.

Column b.

Column c.

Total

Exempt

Taxable

8. Total number of access lines

5. If you are no longer in business and want your

Access Lines

Access Lines

Access Lines

account cancelled, enter the final date

______________

First month of quarter...............

6. If your mailing address has changed, check

Second month of quarter..........

the box and print new address below:

Third month of quarter..............

Total number of access lines....

9. Fee computation (total of column c, times $0.50)

$

|

Signature_______________________________________

10. Uncollectable fees

$ (

|

)

Title___________________________________________

___

11. Uncollectable fees recaptured

$

|

Phone__________________________Date___________

$

|

12. Total fees due (sum of lines 9, 10 and 11)

13. Enter amount paid

with this return

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1