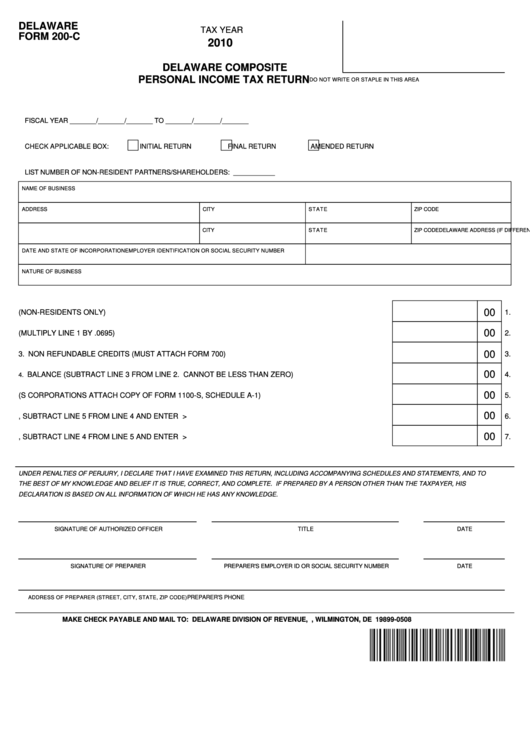

DELAWARE

TAX YEAR

FORM 200-C

2010

Reset

Print Form

DELAWARE COMPOSITE

PERSONAL INCOME TAX RETURN

DO NOT WRITE OR STAPLE IN THIS AREA

FISCAL YEAR _______/_______/_______ TO _______/_______/_______

CHECK APPLICABLE BOX:

INITIAL RETURN

FINAL RETURN

AMENDED RETURN

LIST NUMBER OF NON-RESIDENT PARTNERS/SHAREHOLDERS: ___________

NAME OF BUSINESS

ADDRESS

CITY

STATE

ZIP CODE

DELAWARE ADDRESS (IF DIFFERENT)

CITY

STATE

ZIP CODE

DATE AND STATE OF INCORPORATION

EMPLOYER IDENTIFICATION OR SOCIAL SECURITY NUMBER

NATURE OF BUSINESS

00

1. DELAWARE SOURCED INCOME (NON-RESIDENTS ONLY)...............................................................................

1.

00

2. TAX LIABILITY (MULTIPLY LINE 1 BY .0695)........................................................................................................

2.

00

3.

NON REFUNDABLE CREDITS (MUST ATTACH FORM 700)................................................................................

3.

00

BALANCE (SUBTRACT LINE 3 FROM LINE 2. CANNOT BE LESS THAN ZERO)...............................................

4.

4.

00

5. ESTIMATED TAXES PAID (S CORPORATIONS ATTACH COPY OF FORM 1100-S, SCHEDULE A-1).............

5.

00

6. IF LINE 5 IS LESS THAN LINE 4, SUBTRACT LINE 5 FROM LINE 4 AND ENTER HERE...........PAY IN FULL>

6.

00

7. IF LINE 4 IS LESS THAN LINE 5, SUBTRACT LINE 4 FROM LINE 5 AND ENTER HERE..................REFUND>

7.

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN, INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO

THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT, AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN THE TAXPAYER, HIS

DECLARATION IS BASED ON ALL INFORMATION OF WHICH HE HAS ANY KNOWLEDGE.

SIGNATURE OF AUTHORIZED OFFICER

TITLE

DATE

SIGNATURE OF PREPARER

PREPARER'S EMPLOYER ID OR SOCIAL SECURITY NUMBER

DATE

ADDRESS OF PREPARER (STREET, CITY, STATE, ZIP CODE)

PREPARER'S PHONE

MAKE CHECK PAYABLE AND MAIL TO: DELAWARE DIVISION OF REVENUE, P.O. BOX 508, WILMINGTON, DE 19899-0508

1

1