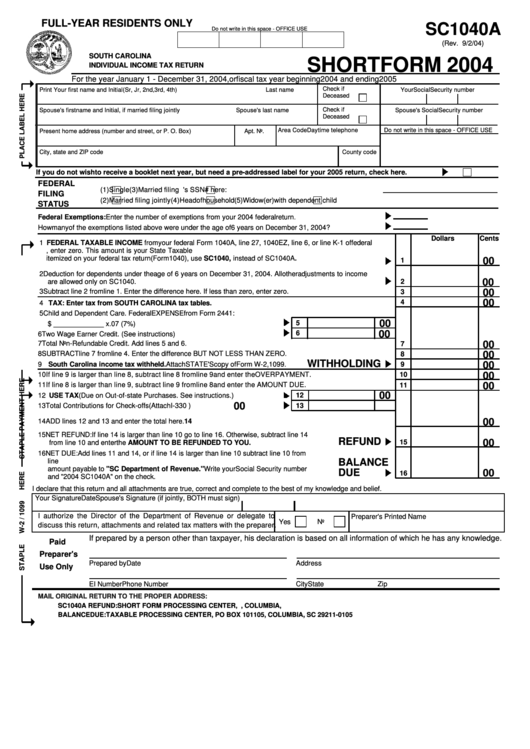

Form Sc1040a - Individual Income Tax Return - Short Form - 2004

ADVERTISEMENT

FULL-YEAR RESIDENTS ONLY

SC1040A

Do not write in this space - OFFICE USE

(Rev. 9/2/04)

SOUTH CAROLINA

SHORT FORM 2004

INDIVIDUAL INCOME TAX RETURN

For the year January 1 - December 31, 2004, or fiscal tax year beginning

2004 and ending

2005

Check if

Print Your first name and Initial

(Sr, Jr, 2nd, 3rd, 4th)

Last name

Your Social Security number

Deceased

Check if

Spouse's first name and Initial, if married filing jointly

Spouse's last name

Spouse's Social Security number

Deceased

Area Code

Daytime telephone

Do not write in this space - OFFICE USE

Present home address (number and street, or P. O. Box)

Apt. No.

City, state and ZIP code

County code

If you do not wish to receive a booklet next year, but need a pre-addressed label for your 2005 return, check here.

FEDERAL

(1)

Single

(3)

Married filing separately. Enter spouse's SSN # here:

FILING

(2)

Married filing jointly

(4)

Head of household

(5)

Widow(er) with dependent child

STATUS

Federal Exemptions: Enter the number of exemptions from your 2004 federal return.

How many of the exemptions listed above were under the age of 6 years on December 31, 2004?

Dollars

Cents

1 FEDERAL TAXABLE INCOME from your federal Form 1040A, line 27, 1040EZ, line 6, or line K-1 of federal

Telefile. If this is a negative amount or zero, enter zero. This amount is your State Taxable Income. If you

itemized on your federal tax return (Form 1040), use SC1040, instead of SC1040A.

00

1

2 Deduction for dependents under the age of 6 years on December 31, 2004. All other adjustments to income

00

2

are allowed only on SC1040.

3 Subtract line 2 from line 1. Enter the difference here. If less than zero, enter zero.

00

3

00

4

4 TAX: Enter tax from SOUTH CAROLINA tax tables.

5 Child and Dependent Care. Federal EXPENSE from Form 2441:

00

5

$ _____________ x .07 (7%)

00

6

6 Two Wage Earner Credit. (See instructions)

00

7 Total Non-Refundable Credit. Add lines 5 and 6.

7

8 SUBTRACT line 7 from line 4. Enter the difference BUT NOT LESS THAN ZERO.

00

8

WITHHOLDING

9 South Carolina income tax withheld. Attach STATE'S copy of Form W-2, 1099.

9

00

00

10 If line 9 is larger than line 8, subtract line 8 from line 9 and enter the OVERPAYMENT.

10

00

11 If line 8 is larger than line 9, subtract line 9 from line 8 and enter the AMOUNT DUE.

11

00

12 USE TAX (Due on Out-of-state Purchases. See instructions.)

12

00

13 Total Contributions for Check-offs (Attach I-330 )

13

00

14 ADD lines 12 and 13 and enter the total here.

14

15 NET REFUND: If line 14 is larger than line 10 go to line 16. Otherwise, subtract line 14

REFUND

00

15

from line 10 and enter the AMOUNT TO BE REFUNDED TO YOU.

16 NET DUE: Add lines 11 and 14, or if line 14 is larger than line 10 subtract line 10 from

line 14. Enter the AMOUNT YOU OWE. Staple a check or money order for the full

BALANCE

amount payable to "SC Department of Revenue." Write your Social Security number

DUE

00

16

and "2004 SC1040A" on the check.

I declare that this return and all attachments are true, correct and complete to the best of my knowledge and belief.

Your Signature

Date

Spouse's Signature (if jointly, BOTH must sign)

I authorize the Director of the Department of Revenue or delegate to

Preparer's Printed Name

Yes

No

discuss this return, attachments and related tax matters with the preparer.

If prepared by a person other than taxpayer, his declaration is based on all information of which he has any knowledge.

Paid

Preparer's

Prepared by

Date

Address

Use Only

EI Number

Phone Number

City

State

Zip

MAIL ORIGINAL RETURN TO THE PROPER ADDRESS:

SC1040A REFUND: SHORT FORM PROCESSING CENTER, P.O. BOX 101104, COLUMBIA, S.C. 29211-0104

BALANCE DUE:

TAXABLE PROCESSING CENTER, PO BOX 101105, COLUMBIA, SC 29211-0105

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1