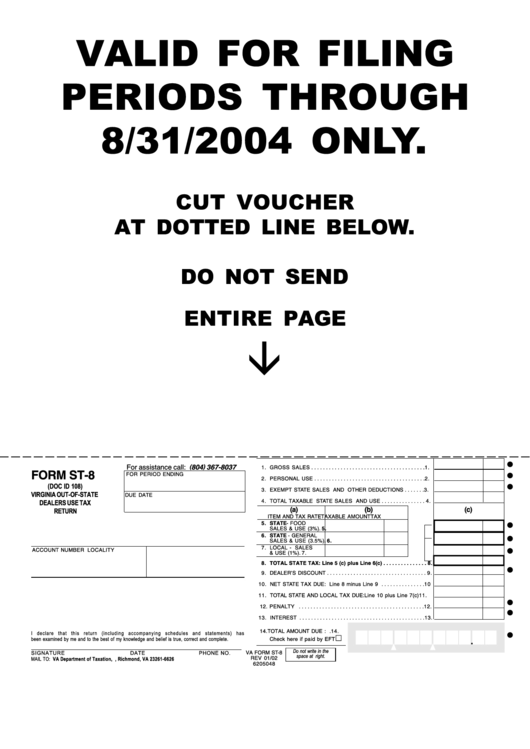

Form St-8 - Virginia Out-Of-State Dealers Use Tax Return

ADVERTISEMENT

VALID FOR FILING

PERIODS THROUGH

8/31/2004 ONLY.

CUT VOUCHER

AT DOTTED LINE BELOW.

DO NOT SEND

ENTIRE PAGE

â

•

For assistance call:

(

804

)

367-8037

1. GROSS SALES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

•

FORM ST-8

FOR PERIOD ENDING

2. PERSONAL USE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

•

(DOC ID 108)

3. EXEMPT STATE SALES AND OTHER DEDUCTIONS . . . . . . . 3.

VIRGINIA OUT-OF-STATE

DUE DATE

4. TOTAL TAXABLE STATE SALES AND USE . . . . . . . . . . . . . . . 4.

DEALERS USE TAX

(a)

(b)

(c)

RETURN

ITEM AND TAX RATE

TAXABLE AMOUNT

TAX

•

5. STATE- FOOD

SALES & USE (3%)

. 5.

•

6. STATE - GENERAL

SALES & USE (3.5%)

. 6.

•

7. LOCAL - SALES

ACCOUNT NUMBER

LOCALITY

& USE (1%)

. 7.

8. TOTAL STATE TAX: Line 5 (c) plus Line 6(c) . . . . . . . . . . . . . . . 8.

•

9. DEALER’S DISCOUNT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

10. NET STATE TAX DUE: Line 8 minus Line 9 . . . . . . . . . . . . . . . 10

11. TOTAL STATE AND LOCAL TAX DUE: Line 10 plus Line 7(c) 11.

•

•

12. PENALTY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. INTEREST . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

•

14. TOTAL AMOUNT DUE : . 14.

I declare that this return (including accompanying schedules and statements) has

.

£

been examined by me and to the best of my knowledge and belief is true, correct and complete.

Check here if paid by EFT

Do not write in the

VA FORM ST-8

SIGNATURE

DATE

PHONE NO.

space at right.

REV 01/02

MAIL TO: VA Department of Taxation, P.O. Box 26626 , Richmond, VA 23261-6626

6205048

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3