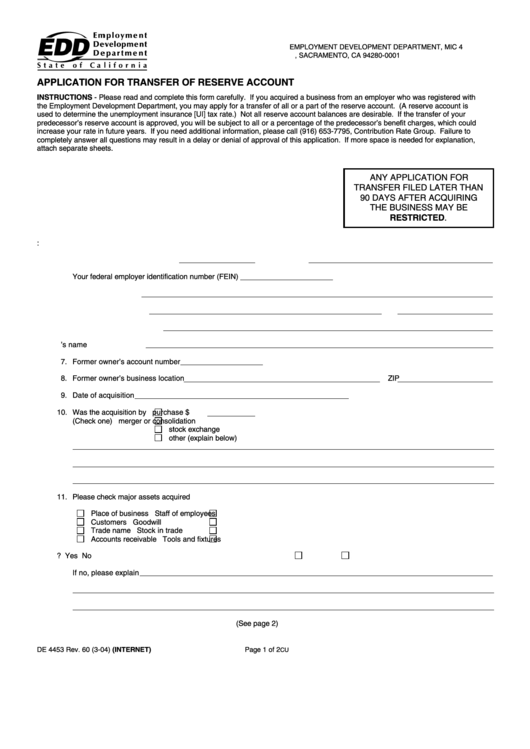

EMPLOYMENT DEVELOPMENT DEPARTMENT, MIC 4

P.O. BOX 826880, SACRAMENTO, CA 94280-0001

APPLICATION FOR TRANSFER OF RESERVE ACCOUNT

INSTRUCTIONS - Please read and complete this form carefully. If you acquired a business from an employer who was registered with

the Employment Development Department, you may apply for a transfer of all or a part of the reserve account. (A reserve account is

used to determine the unemployment insurance [UI] tax rate.) Not all reserve account balances are desirable. If the transfer of your

predecessor’s reserve account is approved, you will be subject to all or a percentage of the predecessor’s benefit charges, which could

increase your rate in future years. If you need additional information, please call (916) 653-7795, Contribution Rate Group. Failure to

completely answer all questions may result in a delay or denial of approval of this application. If more space is needed for explanation,

attach separate sheets.

ANY APPLICATION FOR

TRANSFER FILED LATER THAN

90 DAYS AFTER ACQUIRING

THE BUSINESS MAY BE

RESTRICTED.

I. Complete the following:

1. Your employer account number

2. Your name

Your federal employer identification number (FEIN)

3. Your business name

4. Your business address

ZIP

5. Name of business acquired

6. Former owner’s name

7. Former owner’s account number

8. Former owner’s business location

ZIP

9. Date of acquisition

10. Was the acquisition by

purchase $

(Check one)

merger or consolidation

stock exchange

other (explain below)

11. Please check major assets acquired

Place of business

Staff of employees

Customers

Goodwill

Trade name

Stock in trade

Accounts receivable

Tools and fixtures

12. Did you continue the operation of business you acquired?

Yes

No

If no, please explain

(See page 2)

DE 4453 Rev. 60 (3-04) (INTERNET)

Page 1 of 2

CU

1

1 2

2